2020 Review and 2021 Outlook

It was another strong year of returns for most major asset classes. In 2020, the S&P 500 Index returned 18.40%. This return was generated despite a global pandemic that caused U.S. second quarter real gross domestic product to decrease at an annual rate of 32.9%. The stock market return was powered by unprecedented monetary and fiscal stimulus that allowed the economy to recover after the initial shutdown. The Federal Reserve has made it clear that they will continue to provide support for the markets. In 2021, the market will be focused on how quickly and efficiently the vaccine will roll out. The largest variable for the market is the new administration and how their tax and regulatory policies will impact corporate earnings. The Federal Reserve backstop combined with the current low interest rate environment is why we recommend that clients maintain a neutral asset allocation. For most clients, we would suggest that pullbacks in the market will provide an opportunity to move closer to the higher end of their equity allocation.

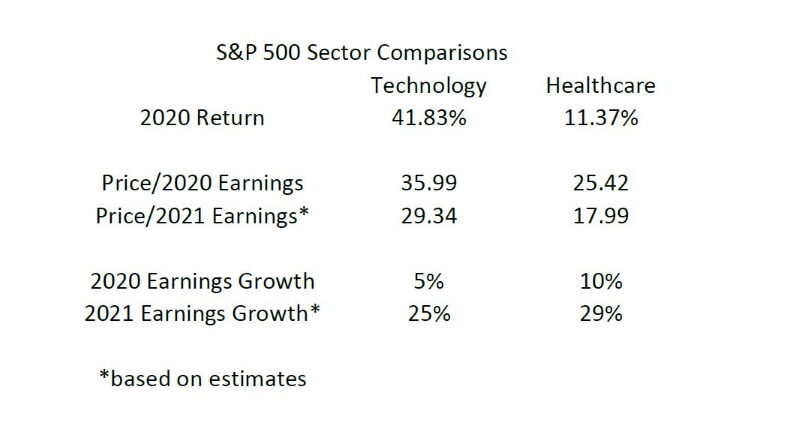

The strong return of the S&P 500 Index was driven by the technology sector, especially the mega cap tech names. The technology sector was up 41.83% for the year. The healthcare sector, despite stronger earnings growth in 2020 and higher earnings growth expectations in 2021, underperformed the technology sector. Like the dot com bubble, we see some stocks in the technology sector as overvalued. In 2020, day traders of the dot com era were replaced by Robinhood traders – who now number over 13 million. In 2020, according to Goldman Sachs, single stock option volumes are now larger than common stock volumes for the first time. Options provide investors an opportunity to leverage their investments with the risk that their investment expires worthless. Thanks to Robinhood, the typical option investment period of months has been replaced by options as short as a week. These short-term option contracts resemble the risk/reward of a lottery ticket. When stocks go up it creates a positive feedback loop that combined with greed has encouraged many new investors to invest in these short-term options and helped drive prices higher.

The Federal Reserve and central banks across the globe have continued to pump money into the economy. This inflow of money has helped drive up the prices of most assets. Monetary and fiscal stimulus totaled approximately 50% of U.S. GDP during the period from March to December. This unprecedented stimulus means more dollars chasing the same amount of assets and driving up the prices. We’re seeing this effect play out in all types of markets because of the excess cash in the system. For example, Bitcoin has seen a significant price increase in 2020 (up almost 300% for the year). This cryptocurrency has the advantage of a maximum number of bitcoins of 21 million, in which 18.5 million have already been mined. Therefore, the supply of bitcoins is fixed at 21 million. Given this relatively small number of bitcoins (Apple has 17.5 billion shares outstanding) it is not feasible for it to be used as currency in any country. However, the fixed supply means that any increase of demand will increase the price. Every large investment will drive up the price of bitcoin. This positive feedback loop will continue as people see an increase in price as a reason to invest in bitcoin. The greater fool theory is in full effect – the hope to sell the asset to someone else at a higher price. However, we’ve seen this feedback loop create multiple bubbles from the tulip mania in the 1600’s to the dot com bubble of 2000 and the housing bubble of the 2000’s. This speculative furor is not limited to bitcoin.

Thanks to the easy money policies we are seeing several stocks at questionable valuations. At Virtue Asset Management, we view these companies as trades and not investments. With a weak link to fundamentals, we view these areas of the market to have the greatest risk. Risk can take many forms from the overall economy to individual company risk. We have discussed the risk of investing in China in the past. Jack Ma, the founder of Alibaba, has had a very tough second half of the year. In the fall, he made negative comments about Chinese government financial system regulation. This caused China to stop the IPO of Ant Financial, rumored to be valued at $500 billion. Next, China has started to investigate Alibaba which has seen a large drop in market value since the announcement. Every company has risk and competition. We prefer to invest with companies that have positive earnings and a solid business plan. We believe these fundamentals provide downside protection versus the more speculative stocks that are trading on future promises of profitability but currently have negative earnings. While the Federal Reserve has demonstrated a quick reaction to down markets, we think they will be less likely to act if only the high growth speculative stocks have a pullback – even in a significant pullback.

The S&P 500 Index returned 18.40% for the year. Large Cap stocks continued to outperform other asset classes. The S&P Mid-Cap Index returned 13.66% for the year. The S&P Small Cap Index returned 11.29% for the year. The S&P 500 has continued to outperform other asset classes. The S&P 500 Index contains the largest U.S. public companies and many of them have limited competition and remained open during the lockdown. In some cases, their competitors were shut down, which only increased the advantages of these companies. Fortunately, through the stock market investors can become owners in these companies. These large companies behave differently than the overall economy, especially compared to the small businesses spread throughout the country. We continue to recommend overweighting large cap stocks compared to mid and small cap stocks.

U.S. Large Cap stocks continue to outperform the rest of the world. International equities, as measured by the MSCI EAFE Index returned 7.92% for the year. Emerging markets, as measured by the MSCI Emerging Markets Index returned 17.56% for the year. We continue to recommend overweighting U.S. stocks compared to international stocks. Fixed income, as measured by the Barclays U.S. Aggregate Bond Index returned 7.51% for the year primarily due to declining interest rates.

With the Democrats sweeping the Georgia senate races it gives the party a slim majority in Congress. The market expects more stimulus. and even higher spending from the new administration. The spending should be beneficial for growth and stock prices in the short term. In the long term, the question is how much government spending will it take to raise interest rates and create higher inflation. Currently, with the 10-year treasury at 1% the market has shown an appetite for government debt. At Virtue Asset Management we view it more likely that rates will rise in 2021 than go down. Therefore, we recommend shorter term bonds and matching maturities with upcoming cash flow needs. Given the expected increase in spending, we view Treasury Inflation Protected Securities (TIPS) as a core part of any fixed income portfolio.

The rollout of effective vaccines should lead to an end of the pandemic by the middle of 2021. This should help spur economic growth for the second half of the year and for 2022. The recent $900 billion stimulus package along with the rollout of the vaccine, should eliminate the risk of a double dip recession in the U.S. Real U.S. GDP should grow between 4-5% in 2021 led by robust consumer confidence and spending due to:

- A high savings rate during the pandemic.

- Pent up consumer demand.

- A strong housing market driven by low mortgage rates and demand from millennials.

- A robust job market led by the recovery of industries such as travel, dining, live entertainment and deferred health care.

For 2021, analysts are estimating earnings of approximately $165 a share for the S&P 500 Index. The current price to earnings (P/E) ratio is 22.76. The last five years the P/E ratio averaged 23.19. With the rollout of the vaccine taking up to six months, expectations are that earnings will still be depressed for 2021. Analysts are predicting earnings of $200 a share in 2022. Using the P/E ratio of 23.19 multiplied by earnings of $200 for the S&P 500 provides a 2022 target of 4,638. This optimistic target relies on a few major assumptions. First, that the P/E ratio will stay elevated versus historical values (it has averaged 20.27 over the last 10 years). If interest rates rise significantly, the P/E ratio should drop. Second, that earnings will grow from $165 to $200 a share in 2021. Finally, that corporate taxes will not be increased. We have historically found analyst earnings to be overly optimistic. We think a more conservative 2022 earnings estimate is $185. This would provide a return of approximately 14% from the current levels. This return compares favorably to a ten-year government bond yielding approximately 1%. With the operational risk of the vaccine rollout combined with the uncertainty of the new administration increases the short-term risk of a temporary double digit pullback. For most clients, we would suggest that pullbacks in the market will provide an opportunity to move closer to the higher end of their equity allocation.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk

Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management