2021 First Half Quarter Review and Outlook

In the second quarter of 2021, the S&P 500 returned 8.55% – setting an all-time high for the index. The strong returns were driven by Covid vaccinations, an opening of the economy leading to increased earnings and an accommodating Federal Reserve. The main question for investors is inflation, how high will it go above 2% and how long will it stay above 2%. Federal Reserve Chair Jerome Powell says that inflation is transitory and is expected to drop back toward their longer-run goal of 2%. At Virtue Asset Management, we expect earnings for the S&P 500 to potentially exceed analysts’ expectations over the next few quarters. We expect inflation to be potentially higher and last longer than current projections. We favor inflation-hedging financial assets and recommend that most clients stay closer to the higher end of their equity allocation, as long as this strategy is also within a client’s risk tolerance.

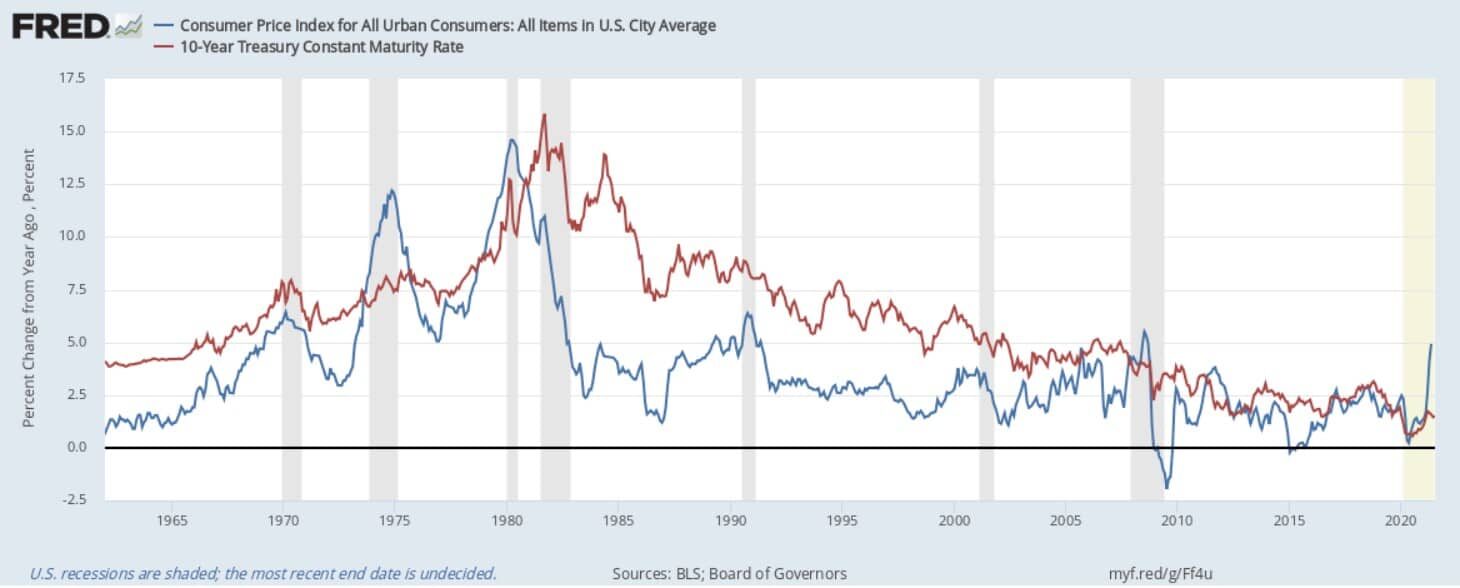

The Consumer Price Index (CPI) increased 5% from May 2020 to May 2021. Prices for all items less food and energy rose 3.8% for the year ended May 2021, the largest 12-month increase since the year ended June 1992. Other measures of inflation are also running hot. The S&P CoreLogic Case Schiller National Home Price Index rose 14.6% in the year that ended in April, the highest annual rate of growth since the index began in 1987. Historically inflation and treasury yields have a positive correlation. During the second quarter inflation accelerated but the 10-year treasury yield declined from 1.74% to 1.45%.

The Federal Reserve’s August 27th, 2020 announcement stated: “following periods where inflation has been running persistently below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time.” The risk is that investors do not know the definition of moderately above 2% or how long is “some time”. What inflation rates will convince the Fed to start tapering its asset purchases, currently purchasing $120 billion in fixed income securities a month? The market may expect the Fed to start tapering before they move forward on any Federal Funds rate increases. Any announcement to start tapering could cause a drop in the market. In 2013, the Fed made a surprise announcement about tapering that caused the S&P 500 to drop around 6% in a month.

Currently, the Federal Fund futures contracts are pricing in a 72% chance of a rate hike by December 2022. The odds of rate hikes to the .50% to .75% range increased to 22.8%. The odds were 15.1% a month ago. An increase in interest rates could be a negative for most growth stocks and companies with high price to earnings (P/E) valuations. This indicator seems to contradict the stock and bond market action in the second quarter. In the second quarter, growth stocks outperformed value stocks and interest rates on the 10-year treasury dropped from 1.74% to 1.45%. Due to the decrease in interest rates the Barclays US Aggregate Bond Index returned 1.83% for the second quarter. The market seems to be pricing in a scenario where inflation is transitory, and the Federal Reserve does not have to raise rates until 2023. At Virtue Asset Management, we expect inflation to be potentially higher and last longer than current expectations. Therefore, we continue to favor value stocks and focus on owning fixed income that offers floating rates or short maturities matched with upcoming cash flow needs.

The strong returns for the second quarter in the S&P 500 were powered by growth stocks. The S&P 500 Growth Index returned 11.93%. The S&P 500 Value Index returned 4.99% for the quarter. The price to earnings (P/E) ratio for the Growth Index is 42.92 versus a 25.07 P/E ratio for the Value Index. U.S. Large Cap stocks continue to outperform the rest of the world. International equities, as measured by the MSCI EAFE Index returned 5.23% during the second quarter. Europe has lagged the United States in both the manufacturing and distribution of vaccines. Emerging markets, as measured by the MSCI Emerging Markets Index returned 4.92%. We continue to recommend overweighting U.S. stocks compared to international stocks. The S&P Small Cap Index returned 4.51% for the second quarter. The S&P Mid-Cap Index returned 3.64% for the first quarter. We continue to recommend overweighting large cap stocks compared to mid and small cap stocks.

Inflation is not the only risk we see for the stock market. The consensus view is that Democrats will use reconciliation in the Senate to increase the corporate tax rate from 21% to 28%. In 2020, the average tax rate for S&P 500 companies was 18.02%. An increase to the corporate tax rate could lower S&P 500 earnings in 2022 between $5 and $10 a share. Recently, 130 countries agreed to impose a 15% minimum tax on corporations. Specific details on the tax need to be finalized and ratification of such a major change is not certain. This new tax could have a significant impact on earnings per share, especially for technology companies since they have the lowest tax rate of any sector.

In the first half of the year, earnings outpaced analysts’ expectations. In the first quarter, earnings for the S&P 500 index were approximately $49 a share. This strong quarter raised 2021 earnings estimates from $158 to $187. We think analysts are being too cautious, especially for second quarter earnings. Analysts are currently predicting a drop in the second quarter to approximately $44 a share. We believe it is more likely that earnings will be equal to or great then the first quarter. We expect earnings to be over $190 a share for 2021. This momentum should carry into earnings for 2022. Analysts are predicting earnings of $210 a share in 2022. Using a P/E ratio of 22 provides a target of 4620. This would provide a return of approximately 8% from current levels. This return compares favorably to a ten-year government bond yielding 1.45%. Given our outlook of stocks versus bonds, we recommend clients stay closer to the higher end of their equity allocation, as long as this strategy is also within a client’s risk tolerance.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with Virtue Asset Management’s financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk.

Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD #283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management