2021 First Quarter Review and Outlook

In the first quarter of 2021, the S&P 500 index returned 6.17% – setting an all-time high for the index. The strong returns were driven by the rapid vaccinations leading to expectations of 2021 GDP growth in the 4 to 5 percent range. The Federal Reserve has made it clear they expect inflation to be over 3% for the short term. More importantly, they have signaled a willingness not to raise federal fund rates as inflation heats up. The current administration has already passed the $1.9 trillion stimulus bill and is in talks to pass an infrastructure bill that could cost $2 trillion. The increased fiscal policy spending combined with a recovering economy has put upward pressure on interest rates. An increase in interest rates causes bond prices to fall. Rising interest rates are the reason the Barclays US Aggregate Bond Index returned -3.37% in the first quarter. We expect the Federal Reserve to be cautious before raising the federal funds rate, but this does not mean that intermediate and long-term interest rates cannot continue to rise. At Virtue Asset Management we continue to recommend shorter term bonds and matching maturities with upcoming cash flow needs.

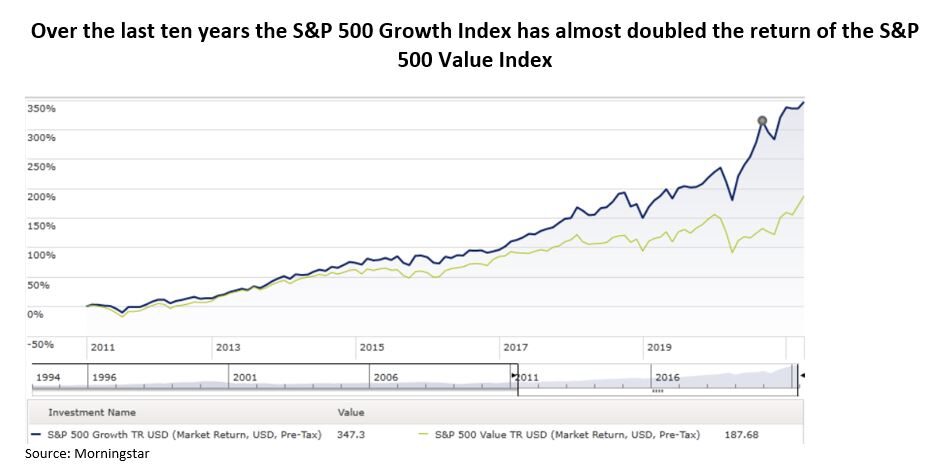

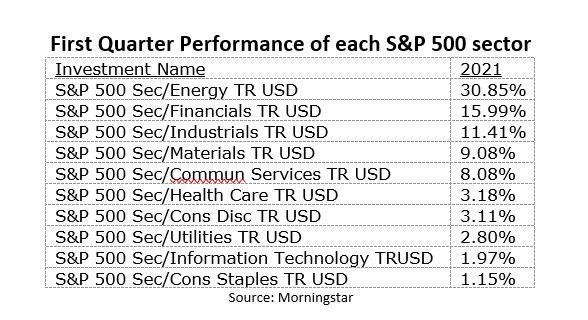

The increase in interest rates contributed to a significant rotation in the equity market with value stocks outperforming growth stocks. In the first quarter, the S&P 500 Value index returned 10.77% compared to the S&P 500 Growth Index return of 2.12%. Valuation was another contributing factor to the outperformance of value stocks. The S&P 500 Value Index has a price to earnings (P/E) ratio of 23.32 and a dividend yield of 2.11%. The S&P 500 Growth Index has a P/E ratio of 38 and a dividend yield of 0.58%. Growth stocks, especially large cap technology stocks, have significantly outperformed value stocks since 2009. An increase in interest rates combined with investors focusing on valuation, dividend yield and a reversion to the mean should favor value stocks going forward. We continue to recommend companies with positive earnings, solid business plans and reasonable valuations. In the first quarter, traditional value sectors such as financials, industrials and energy have outperformed traditional growth sectors such as technology and biotech. This value tilt helped our performance since the beginning of the year.

In the first quarter, the yield of the 10-year Treasury bond went from 0.93% to 1.74%. In the same period, the yield on the 20-year Treasury rose from 1.46% to 2.31%. Due to the increase in interest rates, the 20+ year Treasury bond index returned -13.30%. As we discussed last year, Federal Reserve Chairman Jerome Powell announced a long-term inflation target for the economy. He indicated a willingness to allow inflation to exceed the target of 2% to offset a period of low inflation. The difference in the yield to maturity between the Treasury Inflation Protected Security (TIPS) and the traditional Treasury note is called the breakeven rate or the implied inflation rate. The breakeven rate, which is currently 2.34% on a ten-year TIP, is the average inflation rate that investors expect over the life of the bond. At the start of the year the breakeven rate was 1.99%. We expect interest rates to continue their upward trend and continue to recommend shorter maturity bonds for most portfolios because of this risk. We’re comfortable letting cash grow in accounts in the expectation of purchasing higher yielding bonds later in the year.

The Federal Reserve has made it clear they are not looking to raise short-term interest rates until 2023. They are expected to taper or eliminate asset purchases next year. Currently, the Federal Reserve is purchasing $120 billion of Treasury bonds and mortgage-backed securities each month. If the Federal Reserve stops purchasing bonds, the expectation is that interest rates will rise from their current levels. If the Federal Reserve waits too long to taper or raise interest rates, they risk an overheated economy and higher inflation. If the Federal Reserve raises rates too soon, they risk slowing the economy and increasing unemployment. Our current thesis is that they are more likely to wait too long to raise rates. We expect growth in the economy to accelerate, interest rates to rise and inflation to rise. All these signs point to a better risk/reward for stocks versus bonds.

Thanks to expectations of an economic rebound for 2021, the S&P Small Cap Index returned 18.24% for the first quarter easily beating the 6.17% return for the S&P 500 Index. The S&P Small Cap Index is still fairly valued with a P/E of 22.1. The S&P Mid-Cap Index returned 13.47% for the first quarter. Historically, small and mid-cap companies outperform their large cap brethren coming out of a recession. Another advantage is the lower technology weighting in the small cap index (14.3%) and the mid-cap index (14.7%) versus the S&P 500 (27.4%). In the S&P 500, the technology sector was the second worst performing sector with a return of 1.97%. We continue to recommend overweighting large cap stocks compared to mid and small cap stocks. However, we do warn clients to be mindful of their weighting in technology stocks. The S&P 500 Growth index has a 41.7% weighting in the technology sector. We do think other sectors provide a better risk/reward than most technology stocks.

U.S. Large Cap stocks continue to outperform the rest of the world. International equities, as measured by the MSCI EAFE Index returned 3.48% during the first quarter. Europe has lagged the United States in both the manufacturing and distribution of vaccines. Emerging markets, as measured by the MSCI Emerging Markets Index returned 2.08%. We continue to recommend overweighting U.S. stocks compared to international stocks.

For 2021, analysts are estimating earnings of approximately $158 a share for the S&P 500 Index. The current P/E ratio is 24.70. The last five years the P/E ratio averaged 23.84. With the rollout of the vaccine looking to be completed by the end of the second quarter, expectations are that earnings will accelerate heading into the end of the year. Analysts are predicting earnings of $200 a share in 2022. Using the P/E ratio of 23.84 multiplied by earnings of $200 for the S&P 500 provides a 2022 target of 4,768. With the possibility of an increase in corporate tax rates, we think a more conservative 2022 earnings estimate is $185. This would provide a return of approximately 13% from the current levels. This return compares favorably to a ten-year government bond yielding 1.74%. Given our outlook of stocks versus bonds, we recommend clients maintain at least a neutral equity weighting. For most clients, we would suggest that pullbacks in the market will provide an opportunity to move closer to the higher end of their equity allocation.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk

Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.