2022 Review and 2023 Outlook

The S&P 500 Index did rally in the fourth quarter gaining 7.56% but still finished the year down 18.11%. The last year with a negative return for the S&P 500 was 2018 (down 4.38%). The last year with a double-digit negative return was 2008 (down 37.0%). Corporate earnings in 2022 look to be slightly lower than 2021. The combination of lower earnings and higher interest rates drove down the price to earnings (P/E) ratio that investors were willing to pay for the S&P 500. This multiple compression was especially true for high growth stocks. The Russian invasion of Ukraine and China sticking to its zero covid policy contributed to higher inflation for the year. High inflation forced the Federal Reserve to aggressively raise interest rates to fight further inflation. At Virtue Asset Management, we believe that the Federal Reserve is close to the end of rate hikes. The ending of rate hikes should benefit bonds in the first half and equities in the second half of the year. Dependent on a client’s risk/reward tolerance, we recommend in the first quarter that cash be moved to bonds or stocks to take advantage of higher returns over the next twelve to twenty-four months.

The invasion of Ukraine and China’s zero covid policy contributed to the increase of inflation in 2022. At the beginning of the year, expectations were for the Federal Reserve to enact three one-quarter point interest rate hikes. Instead, in response to higher inflation, the Federal Reserve raised the federal funds rate from 0.25% to 4.5%. The market is pricing in additional raises and expects the rate to eventually reach 5.25% in the second quarter of 2023. We believe that inflation peaked in the second quarter of 2022. According to the latest data from the S&P/Case Shiller US National Home Prices Index the index is down 2.67% over the last three months through October. A downturn in housing is no surprise given the doubling of mortgage rates over the past year. This is important because shelter costs make up 33% of the CPI. We expect shelter costs to help lower the CPI in 2023.

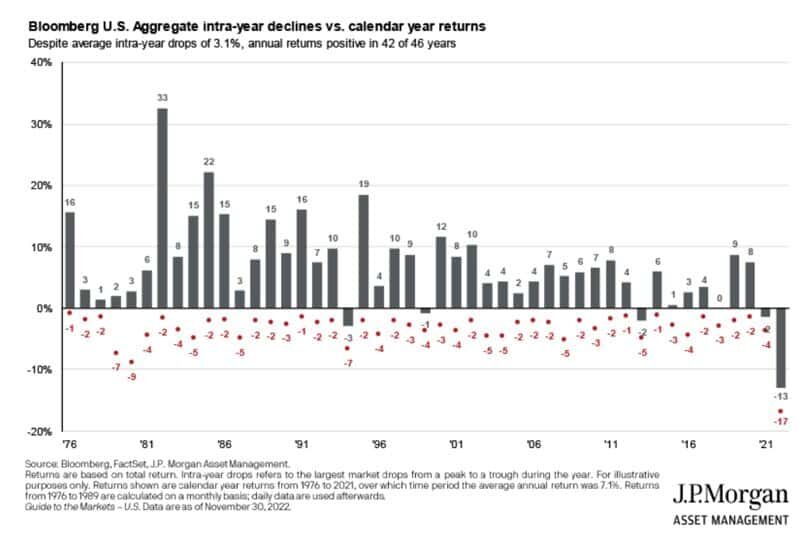

The Federal Reserve raised rates more than expected at the beginning of the year. The increase in interest rates led to a loss of 13.01% for the Bloomberg U.S Aggregate (Bond) Index, the worst annual return since it was created in 1976. The index has had a positive return in 42 of the last 46 years and never experienced a double-digit loss before. Instead of offsetting equity losses, fixed income created downward pressure for portfolios holding bonds. Last year was a rare occurrence of both fixed income and equites down double digits. At the beginning of the year the 10-year Treasury yielded 1.63%. In late October it peaked at 4.25% and finished the year at 3.88%.

A catalyst for fixed income in 2023 is the Federal Reserve ending rate hikes and possibly cutting rates in the fourth quarter. In fact, the market expects the Federal Funds rate at the end of the year to be between 4.5% and 4.75%. After a peak of 5.25% in the spring, investors are pricing in interest rate cuts in the second half of the year. The strongest support for this scenario is an inverted yield curve with three-month T-bills currently yielding 4.42% and the 10-year note at 3.88%. Normally investors demand higher yields for longer maturity bonds. The inverted yield curve implies that investors expect a slower economy in 2023 with slightly lower interest rates in the future. We continue to recommend that clients should start moving cash to fixed income and extend maturities in their bond portfolios to take advantage of the current interest rates.

At the beginning of the year, analysts estimated earnings for the S&P 500 at $220. Currently, earnings for the S&P 500 for 2022 are projected to be around $200. The lower earnings for 2022 were driven by a drop in the consumer discretionary sector ($10 lower in 2022 versus 2021) and a drop in the financial sector ($26 lower in 2022 versus 2021). Amazon is the largest company in the consumer discretionary sector and a good example of what went wrong for some companies in 2022. Amazon, like many companies, thought that covid had permanently changed habits of consumers. They ramped up spending and hiring only to see revenue not meet the growth they experienced during covid. Higher interest rates slowed down loans, mortgages and companies looking to go public or issue fixed income. These negative factors drove down the earnings of the financial sector.

The financial sector should perform better next year with interest rates stabilizing and the possibility of interest rate cuts. Other sectors should see improvement with cost cutting measures companies have taken. We do expect the labor market to weaken and the economy to slow, but any recession should be mild and short-lived. For 2023, analysts are estimating earnings for the S&P 500 at $226. Using the last twelve months of earnings the price to earnings ratio (trailing P/E) for the S&P 500 is approximately 19. Using consensus estimates of $226 and the trailing P/E of 19 provides a target of 4,294 for the S&P 500. This would provide a return of approximately 11% from current levels. Dependent on a client’s risk/reward tolerance, we recommend in the first quarter that cash be moved to stocks to take advantage of higher returns over the next twelve to twenty-four months.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection, and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives, and tolerance for risk.

Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management