2022 Third Quarter Review and Outlook

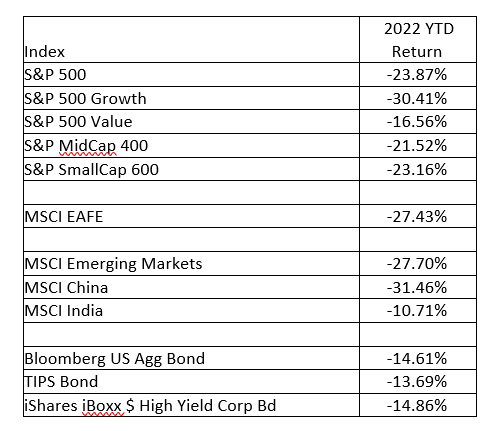

The S&P 500 finished the third quarter down 4.88% and down 23.87% for the year. The decline in stock prices is primarily due to a compression of stock price earnings multiples due to rising interest rates. The Federal Reserve has raised the federal funds rate to 3.25% and the 10-year Treasury has risen to 3.83% at the end of the quarter. The increase in interest rates has provided an opportunity to invest in taxable bonds that offer returns over 4%. The Federal Reserve has forecasted rate cuts in 2025 and in the past has cut rates significantly during recessions. These factors lead us to recommend to clients that they should start moving cash to fixed income and extend maturities in their current bond portfolios to take advantage of the higher interest rates. We expect increased volatility in equities in the short term but view the next few months as a buying opportunity for investors willing to take the longer-term view.

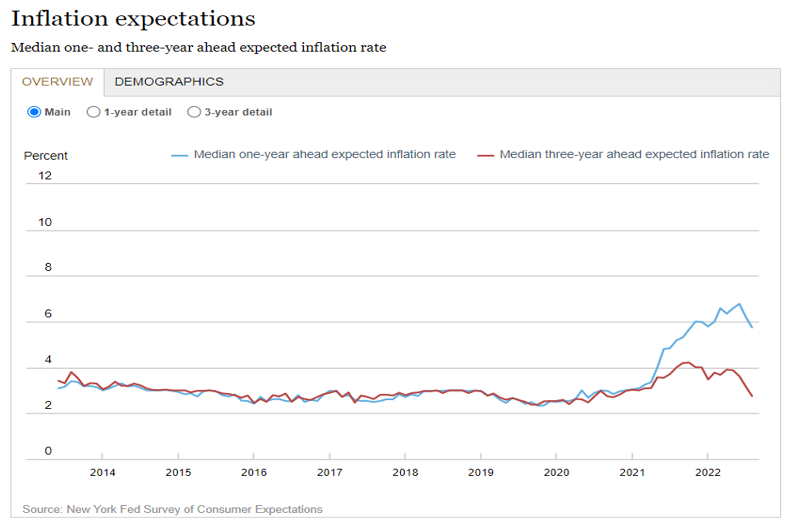

Market expectations are that the Federal Reserve will raise the federal funds rate between 4.5% to 5% by the spring of 2023 and that interest rates will decline after reaching this level. In September, the Federal Reserve released their expectations for interest rates in 2025 with most members coming in under 3.37%. After 2025 most members think rates will be below 2.62%. In September, the New York Federal Reserve released their consumer expectations of inflation. The median one-year expectations have dropped from their peak and the median three-year expectations are near August 2020 levels and close to 2%.

Investors willing to purchase bonds with maturities over five years can purchase taxable investor grade bonds over 5% and tax-free municipal bonds over 3%. In the next few years, if interest rates move closer to 2%, these bonds should provide a solid return for investors. These bonds will see more upside if the Federal Reserve cuts interest rates closer to zero because of a recession or deflationary environment. The potential for lower interest rates is why we are recommending exposure to high yield where appropriate. Currently high yield funds are yielding over 8%.

The Federal Reserve comments about future rate increases has the added benefit of lowering inflation expectations for the market. Currently, the 5-year breakeven rate is 2.33%. This is the difference between the 5-year Treasury rate and the 5-year Treasury inflation-indexed security rate. The market is pricing in an average of 2.33% inflation over the next five years. The Federal Reserve may not achieve their soft landing, but the market is pointing to much lower inflation over the next five years. Low inflation equals low interest rates. Low interest rates should be beneficial to both equities and fixed income.

We expect the economy to soften and the financial markets to remain volatile over the next several months. The 24% decline in the S&P 500 Index this year tells us that investors have already priced in a recession. Experience also tells us that the stock market is forward looking, so any data indicating that the Fed’s aggressive monetary tightening is near an end would be a positive for the market. Historically the stock market will start to recover before the economic data rebounds. Market bottoms are a process and impossible to predict. We believe that investors should look for several clues that a market bottom is at hand. First, we need to see evidence that inflation has peaked and is starting to moderate. The recent declines in commodity and oil prices, and fewer supply chain bottlenecks, offer some evidence that inflation is moderating. Second, we would look for signs that bond yields have peaked, especially 10-year Treasury yields. Historically long-term bond yields peak before the end of a Federal Reserve tightening cycle, leading to an inverted yield curve. The recent inversion of the yield curve between one-year (4.05%) and ten-year yields (3.83%) is a sign that the economy may weaken, and the Fed is toward the end of the tightening cycle.

Analysts have adjusted 2022 S&P 500 earnings estimates down to $209 a share from $224 a share. The forward price to earnings (P/E) ratio is 17.15 compared to 21.66 at the beginning of the year. The average P/E over the last twenty years is 18.7 and over the last ten years is 19.94. Analyst estimates for 2023 have come down from $250 to $239 a share. If you divide the current price of the S&P 500 (3586) by the twenty-year average P/E (18.7) it implies earnings of $192 for 2023. At this level, we think the market has overreacted and priced in too deep of an earnings recession for 2023. The market will have short term risks for the rest of the year as it focuses on upcoming inflation data. We think the S&P 500 provides long-term value at this level. We recommend our clients confirm they are above a neutral asset allocation. Clients that have excess cash should take advantage of the higher interest rates in bonds and prepare a plan to add to equities if necessary.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection, and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives, and tolerance for risk.

Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management