2023 First Quarter Review and 2023 Outlook

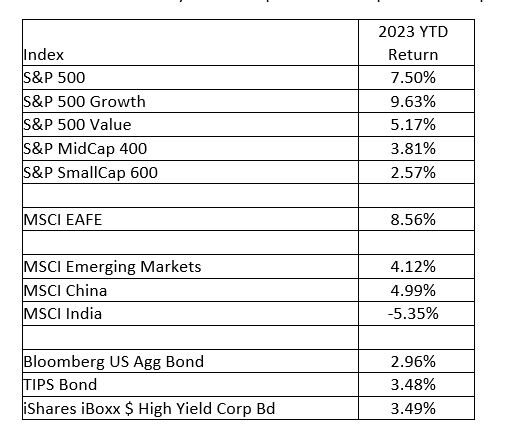

The first quarter saw positive returns for most stocks and bonds. In the first quarter, the S&P 500 Index returned 7.50% and the Bloomberg U.S. Aggregate (Bond) Index returned 2.96%. The market experienced high volatility due to investors changing inflation expectations. Inflation has decreased from the peak of 2022 but remains higher than the Federal Reserve’s target. The market was pricing in federal funds rate hikes through the end of 2023 until the failure of Silicon Valley Bank. With the stress in the banking sector, the market now expects federal funds rate cuts by the end of 2023. As the Federal Reserve enters a period of pausing and then cutting rates, we expect equities to perform well during this transition period. At Virtue Asset Management, we expect the market to start positioning into equities in anticipation of future rate cuts. Dependent on a client’s risk/reward tolerance we recommend that clients use cash to take advantage of the higher federal funds rates in bonds and confirm their equity level is above neutral.

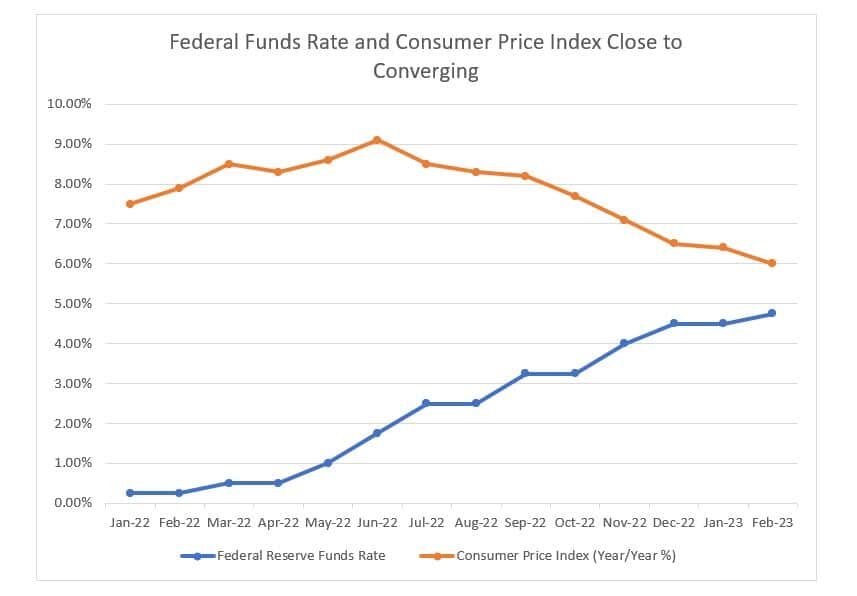

Inflation continues to slowly come down from the peak established in 2022. In June of 2022 the Consumer Price Index (CPI) recorded a 9.1% increase from the year earlier. The CPI has declined from the peak with readings of 6.4% for January and 6.0% for February. The Cleveland Federal Reserve runs a CPI forecasting model that has been very accurate in projecting the inflation numbers. They are projecting 5.66% year over year change for March. A number below 6% would mean ten months in a row of declining inflation. Many economists recommend that federal funds rates need to be higher than inflation in order to tame inflation and get it to the 2% long term goal of the Federal Reserve. At Virtue Asset Management, we expect inflation to be lower than federal funds rates by the end of the summer. This should allow the Federal Reserve to pause federal funds rate hikes.

Over the past year, the Federal Reserve raised federal funds rates nine times from a range of 0% to .25% to the current range of 4.75% to 5%. The increase of federal funds rates by 4.5% in twelve months has been a significant shock to the economy. The increase in federal funds rates caused a decrease in prices of long dated bonds. Following the 2009 financial crisis, banks were encouraged to invest in US Treasury and Mortgage bonds. Unfortunately, over the last few years with low interest rates some banks, such as Silicon Valley Bank, purchased these bonds with maturities over 10 years. These long-dated bonds created large losses on paper this year. If the banks can hold the bonds until maturity they will receive their principal back. The downside is the lower interest rates they will receive until the bond matures. In the case of Silicon Valley Bank, on a single day, $42 billion of deposits out of a total of $225 billion were withdrawn from the bank. Silicon Valley Bank was forced to sell these long-dated bonds at a loss to meet the withdrawals. This action created a negative feedback loop as the losses wiped out the equity in the bank. Depositors realized the bank did not have enough assets to meet liabilities and the bank run continued. On March 12th, the Federal Deposit Insurance Company (FDIC) took over Signature Bank in New York and Silicon Valley Bank. The market started reviewing most banks to determine if they had more losses in bonds than overall equity. The concern was not limited to US Banks, depositors withdrew enough money from Credit Suisse that it was forced to sell itself to rival UBS. Fortunately, the U.S. and Switzerland Government were quick to act to save depositors. Actions have been taken to help banks meet liquidity withdrawals. These actions helped put the market at ease and most bank stock prices have stabilized.

The failure of Silicon Valley and Signature Bank drastically changed market expectations of future Federal Reserve federal funds rate hikes. A month ago, the market expected federal funds rates to be between 5.25% and 5.5% in December 2023. Currently, the market is expecting the Federal Reserve to cut federal funds rates to the range of 4.25% to 4.5%. Historically, a reduction of federal funds rates has been very positive for equities. Crandall, Pierce & Company reviewed the fourteen time periods since 1950 when federal funds rates were falling or flat. The median length was 25 months and during those time periods the median return, after inflation, was 11.7%. We expect the Federal Reserve to pause and possibly cut rates in the second half of the year. We expect this to be positive for equities.

The U.S economy continues to grow. The 2022 fourth quarter gross domestic product (GDP) grew at 2.6%. The Atlanta Federal Reserve has a forecasting model and they are predicting 2.5% GDP growth for the first quarter. We do expect the labor market to weaken and economy to slow, but any recession should be mild and short-lived. For 2023, analysts are estimating earnings for the S&P 500 at $219. Using the last twelve months of earnings the price to earnings ratio (trailing P/E) for the S&P 500 is approximately 19. Using consensus estimates of $219 and the trailing P/E of 19 provides a target of 4,161. This would provide a return of approximately 2% from the current level. However, for 2024, analysts are estimating earnings for the S&P 500 at $245. If these estimates are correct, using the trailing P/E of 19 provides a target of 4,655. This would provide a return of approximately 14% from the current level. Dependent on a client’s risk/reward tolerance we recommend that clients use cash to take advantage of the higher federal funds rates in bonds and confirm their equity level is above neutral.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection, and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives, and tolerance for risk.

Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.