2023 Review and 2024 Outlook

It was an excellent year for most equity indexes. In 2023, the S&P 500 Index returned 26.29% and finished near an all-time high. The strong returns were powered by a US economy that was able to avoid a recession. Lower inflation contributed to the strong market returns and the market is now pricing in interest rate cuts in 2024. The expectation of lower inflation and lower interest rates increased the price to earnings (P/E) ratio investors were willing to pay for stocks, especially growth and technology stocks. At Virtue Asset Management, we believe the market has overestimated the number of interest rate cuts for 2024. We worry that data or events in the first half of the year may drive the Federal Reserve to wait longer before they cut interest rates and/or not cut as many times as the market is predicting. If the market must adjust its expectations for interest rate cuts, it could lead to an increase in bond yields and a pullback in equities. Depending on a client’s situation, we are rebalancing equity exposure, if it can be done with minimal tax consequences. We recommend that clients move their equity levels closer to neutral and use the proceeds to invest in short-term bonds.

Despite a series of interest rate increases by the Federal Reserve the economy was able to avoid a recession. The Gross Domestic Product (GDP) was positive throughout the year. In the first quarter, it was 2.2%, in the second quarter it was 2.1% and in the third quarter it was 4.9%. The economy was helped by lower energy prices, the gradual end of supply chain disruptions, the introduction of new artificial intelligence applications and continued low unemployment. This strong growth helped power corporate earnings for the economy and increased confidence in investors that the US economy would avoid a recession.

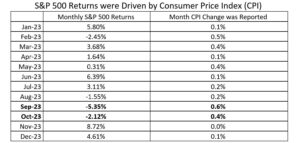

At Virtue Asset Management, we believe that inflation was the biggest driver of stock market returns in 2023. We expect this correlation to continue in 2024. One of the main ways to measure inflation is the Consumer Price Index (CPI). The CPI is reported about two weeks after the end of the month. We will not get the December numbers until January 11th (Editor’s note: CPI rose by .3% in December, higher than expected). Inflation, as measured by the CPI was 3.14% year over year in November. This compares favorably to the start of the year when inflation was 6.4% year over year. The major decrease in inflation helped lower interest rates, increased the price to earnings ratio the market was willing to apply to earnings and helped the S&P 500 have a strong finish to the year. If you look at the second half of the year, the worst months (August through October) for the S&P 500 returns were also the highest monthly percentage change in the CPI. The benign inflation numbers reported in November and December led to an expectation of rate cuts in 2024. This Federal Reserve pivot on interest rates led to a sharp decrease in bond yields and ignited a strong stock market rally.

Currently, futures prices imply a total of six rate cuts (.25% each) by the Federal Reserve to a range of 3.75% to 4.0% at year-end. The Federal Reserve dot plot released in December predicted only three (.25% each) cuts in 2024. In the best-case scenario, the Federal Reserve sees inflation trending towards their 2% long-term goal and aggressively cuts rates in time to avoid a recession. This scenario would prove the market correct with their prediction of six rate cuts and provide a catalyst for strong returns in the stock market for 2024. An alternative scenario is that the Federal Reserve is more cautious in their interest rate cuts and follows the dot pot plan. Our concern is that one month of bad inflation data, even if it is an outlier, would cause the market to pull back from the current levels.

In 2023, the volatile inflation numbers had a direct impact on interest rates. In April, a month where the CPI monthly change was reported at .1%, the 10-Year Treasury reached an interest rate low for the year at 3.3%. In October, a month where the CPI monthly change was reported at .4%, the 10-Year Treasury reached an interest rate high for the year at 4.98%. In November and December, CPI monthly numbers were reported at 0% and .1% respectively. The lower inflation numbers increased market expectations for interest rate cuts in 2024 driving down the interest rate on the 10-Year Treasury to 3.86% at the end of the year. The decrease in interest rates over the last two months helped the Barclays Aggregate Bond Index return 5.53% for 2023. This was the first positive return for the index since 2020. We believe that the market has priced in too many rate cuts for 2024 and that rates could increase early in the year. We recommend that clients with cash purchase short term bonds and wait for a better opportunity to buy bonds with longer maturities.

In 2023, earnings for the index are estimated to be $214 a share. That is a trailing price to earnings (P/E) ratio of 22.37. For 2024, analysts are estimating earnings of approximately $242 a share. Using those estimated earnings, the forward P/E is currently 19.73. Over the last ten years, the forward P/E has averaged 20.78. If you apply the ten-year average of 20.78 to the earnings expectations of $242 you would get a target for the S&P 500 of 5,028. We consider the S&P 500 fairly valued because that target would provide a return of approximately 5% from the current levels. Depending on a client’s situation, we are trimming equities if it can be done with minimal tax consequences. We recommend that clients move their equity levels closer to neutral and use the proceeds to invest in short-term bonds

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management