2023 Third Quarter Review and Outlook

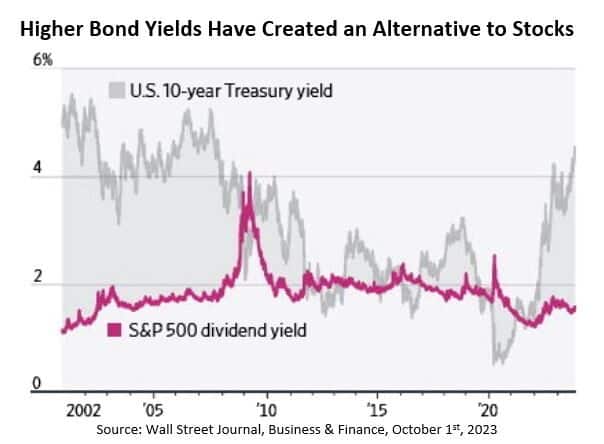

The S&P 500 finished the third quarter down –3.27% but is still up 13.07% for the year. The stock price decline was partly driven by investors’ changing expectations of future interest rates. The Consumer Price Index (CPI) increased 3.7% from August 2022 to August 2023. This increase was higher than the year-over-year change in July (3.2%) and June (3%) and is still above the Federal Reserve inflation target of 2%. Investors now expect the Federal Reserve to keep interest rates higher for longer than expected at the beginning of the quarter. For some investors, higher bond yields have created an attractive alternative to stocks. Currently, investors can purchase a two-year treasury and receive 5.03% in annual interest. At Virtue Asset Management, we believe that stock market returns will be subdued until inflation trends are lower than the current level. We recommend that clients prepare for higher volatility. Long-term investors should maintain their current stock position but raise cash to cover upcoming distributions when appropriate.

So far, the Federal Reserve has done a good job of engineering a soft landing for the economy – reducing inflation without creating a recession. There are risks to completing a soft landing, but the economy is in a much better place now than twelve months ago. In September 2022, the CPI year-over-year change was 8.2% and the Federal Funds interest rate range was 3% to 3.25%. In the last twelve months, the Federal Reserve has raised the Federal Funds range to 5.25% to 5.5% and shrunk its balance sheet by $800 billion (by not repurchasing bonds when they mature). Despite this monetary tightening, the CPI was 3.7% year over year and gross domestic product (GDP) is still positive. In the second quarter, GDP was up 2.1% and the Federal Reserve now expects growth next year at 1.5% – compared with an estimate of 1.1% at the end of the second quarter. More importantly, if the economy enters a recession, the Federal Reserve can cut interest rates significantly to help the economy and still have rates higher than the current rate of inflation.

One risk to a soft landing is the commercial real estate market, especially the office market. The office market has been hurt by low occupancy due to the work-from-home shift and the dramatic increase in interest rates. According to Deutsche Bank analyst Luke Templeman, the actively managed commercial real estate market consists of $1.5 trillion in private fund assets under management and $1.2 trillion of public US Equity real estate investment trusts (REITs). He estimates that the office market comprises 23% of private real estate exposure compared to 5.4% of public REITs. Most commercial real estate is financed by short-term loans and will have to be refinanced over the next five years. Templeman estimates that commercial real estate loans make up 30% of smaller banks’ assets versus 6.5% for larger banks. The drop in commercial real estate prices should hurt private investors and small banks the most. At Virtue Asset Management, we think it is too early to start buying assets overly exposed to office commercial real estate. We continue to monitor the market to see if stress moves to other sectors.

Most asset classes had negative returns in the third quarter. Domestic large-cap stocks continue to perform better than mid-cap, small-cap and international stocks. We continue to recommend overweighting US large-cap stocks given their higher margins, strong cash flow, and ability to operate without a need for loans at current higher interest rates. With the increase in interest rates, longer-maturity bonds performed worse than shorter-maturity bonds. At Virtue Asset Management, we think we are getting closer to the peak in interest rates. The US has approximately $33 trillion in debt. To sustain this debt over the long term, interest rates must come down from their current levels.

In September, Federal Reserve Chair Jerome Powell said “It can be a miserable period to have inflation constantly coming back and the Fed coming in and having to tighten again and again. So, the best thing we can do for everyone, we believe, is to restore price stability.” The market believes the Federal Reserve will sustain price stability by keeping interest rates higher for a longer time period. A month ago, the market expected interest rates in December 2024 to be between 4.25% and 4.5%. After the higher inflation numbers and Powell’s comments the market priced in interest rates in December 2024 to be between 4.75% and 5%. This change in expectations caused the ten-year treasury yield to rise from 4.09% to 4.61% during September. Some investors are content with selling stocks and leaving the volatility of the stock market to earn 4.61% a year. At Virtue Asset Management, we disagree with this approach for most clients. From January 1950 to June 2023, according to Crandell, Pierce and Company, the rolling ten-year return of the S&P 500 averaged a 10.7% annual return. While past performance is no guarantee of future results, we think the long-term risk/reward favors stocks over fixed income. We recommend some fixed-income exposure to dampen portfolio volatility and cover upcoming distribution needs.

The positive GDP growth continues to help raise earnings estimates for the S&P 500. Current estimates for the S&P 500 in 2023 are $220 a share – it was $217 at the end of the second quarter. The forward price to earnings (P/E) ratio using the $220 earnings is 19.7. This is slightly below the 10-year average of 20.7. Earnings estimates for the S&P 500 in 2024 are $245 a share. Using a P/E of 20 would provide a target of 4900 for the S&P 500 – an increase of approximately 13%. At Virtue Asset Management, we believe that stock market returns will be subdued until inflation trends are lower than the current level. We recommend that clients prepare for higher volatility and raise cash to cover upcoming distributions when appropriate.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management