2024 First Half Review and Outlook

In the first half of the year, the S&P 500 Index delivered a 15.64% return, fueled by significant gains in artificial intelligence and chip stocks, especially Nvidia. Large-cap domestic stocks have once again outperformed other major asset classes, including international stocks. Fixed income continues to yield lower returns compared to equities. Investors have adjusted their expectations, anticipating that the Federal Reserve will maintain higher interest rates for an extended period. We believe the Federal Reserve will be hesitant to cut interest rates due to the growing economy, low unemployment rate, and strong stock market. Rate cuts are not expected until there is a reversal in one of these key economic indicators. Given the robust stock market performance, we advise investors to review their equity allocations and identify any concentrated risks in their portfolios. With the recent run-up in the stock market and the uncertainty surrounding President Biden as the Democratic candidate, we expect the stock market to move sideways in the third quarter. Additionally, we recommend clients assess their cash flow needs for the next 18 months and raise sufficient cash to meet those needs.

Quantitative tightening (QT) is a monetary policy tool used by central banks to decrease the amount of money circulating in the economy. It involves reducing the central bank’s balance sheet by selling government bonds or allowing them to mature without reinvesting the proceeds. By reducing the money supply, QT aims to control inflation, which can rise if there is too much money circulating in the economy. As of mid-2024, the Federal Reserve is allowing $25 billion in bonds to roll off its balance sheet each month as part of its QT program. This represents a reduction from the previous amount of $35 billion per month, which was the rate set when the QT program was more aggressive. The reduction indicates a slight easing in the Fed’s approach to tightening monetary policy.

Despite the Federal Reserve’s efforts at QT, the impact is significantly countered by the federal government’s substantial deficit spending. So far, in fiscal year 2024, the government has run a cumulative deficit of $1.2 trillion. According to the Congressional Budget Office, this deficit is projected to reach $1.9 trillion by the end of the year, averaging approximately $150 billion per month. This deficit spending counteracts the objectives of QT, contributing to ongoing economic growth despite high interest rates. Additionally, it is a significant factor in persistent inflation, despite efforts to cool the economy through QT and higher interest rates.

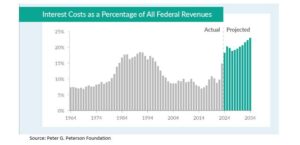

In the last fiscal year (2023), the U.S. federal government paid approximately $659 billion in interest on its debt, marking a significant increase from the $476 billion paid in fiscal year 2022. Furthermore, the annualized rate of interest payments surged past $1 trillion as of October 2023. This rise in interest payments is primarily driven by increased federal deficits and higher interest rates. The Federal Reserve recognizes the economic and budgetary risks of maintaining high interest rates over the long-term. At Virtue Asset Management, we believe the Federal Reserve will maintain higher interest rates in the short-term to potentially lower them more aggressively in the long term. We anticipate rate cuts in 2024 only if there is significant weakness in the economy, job market, or stock market. The first rate cut may not come until after the election or early 2025.

The stock market values predictability over uncertainty. Previously, the market was less concerned about the presidential election because both candidates had already served as president. Despite significant differences in their platforms, the market could reasonably predict the economic outcomes if either candidate won. However, this calculation changed after the first presidential debate. President Biden’s performance raised questions, even from supportive sources like The New York Times editorial board, which called on him to drop out of the race. The uncertainty surrounding Biden’s candidacy and potential replacement is expected to be a short-term drag on the market. We anticipate some volatile market days as news about the situation occasionally makes headlines. The good news is that this is a short-term concern, with the election taking place in November.

The stock market is forward-looking and has been fueled by the excitement surrounding artificial intelligence. Nvidia’s stock has gained approximately $1.8 trillion in market cap this year. Remarkably, it took just 30 days for Nvidia to increase its market cap from $2 trillion to $3 trillion. In contrast, Berkshire Hathaway, under Warren Buffet’s leadership for the past 60 years, still does not have a trillion-dollar market cap. Over the last twelve months, Berkshire reported revenues of approximately $370 billion, compared to Nvidia’s $80 billion. However, thanks to their advantage in chip technology, Nvidia achieved a gross profit of $60 billion in the past year, while Berkshire’s gross profit was $94 billion. The market’s excitement is clearly driven by Nvidia’s impressive growth and profit margins.

Given the robust performance of the stock market, we advise investors to review their equity allocations and identify any concentrated risks in their portfolios, including concentration in sectors such as technology. Depending on an individual investor’s risk/reward profile, it might be prudent to lower the overall equity percentage of a portfolio or explore solutions for concentrated positions. One strategy for managing concentrated stocks is to sell covered call positions and use the income to purchase puts, creating a price floor for the stock and locking in some gains (click here for more information).

In 2024, the earnings for the S&P 500 Index are projected to be $240 per share, resulting in a price-to-earnings (P/E) ratio of 22.75. Over the past decade, the average forward P/E has been 20.90. Based on this comparison, we believe the S&P 500 is fairly valued, as the current P/E is only slightly above the 10-year average. Analysts forecast a 15% earnings growth in 2025, bringing earnings to approximately $276 per share. If these projections hold true, the S&P 500 is expected to significantly outperform fixed income investments through 2025. However, there is a risk that these earnings estimates may be overly optimistic and that inflation could remain above the Federal Reserve’s target. Given these uncertainties, we are advising clients who are overweight stocks to trim equities and concentrated positions where it can be done with minimal tax implications. We recommend that clients adjust their equity holdings to more neutral levels and reallocate the proceeds into longer-term bonds.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management