2024 First Quarter Review and Outlook

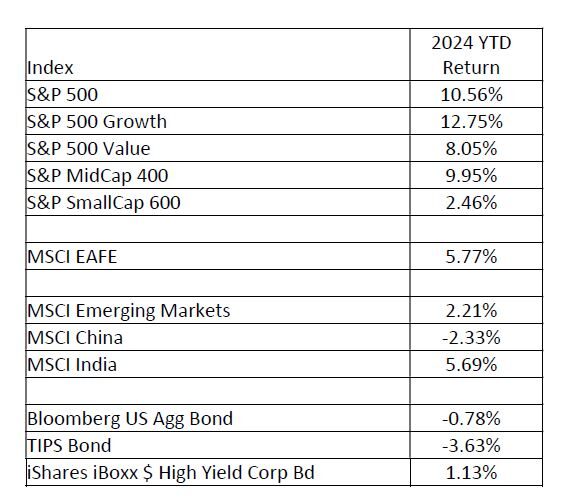

It was a strong first quarter for large-cap stocks as measured by the S&P 500 Index. The S&P 500 hit over 20 record highs and finished the quarter up 10.56%. The excellent returns were powered by a growing US economy and optimism about artificial intelligence stocks. Once again, large-cap domestic stocks significantly outperformed the other major asset classes. In the first quarter, fixed income had a small negative return. Investors adjusted down their expectations for Federal Reserve interest rate cuts in 2024 from six to three (.25% each). The adjusted expectations lead to an increase in bond yields which we predicted in our year-end outlook. With the strong first quarter for large-cap stocks and current valuations, we are cautious about returns for the rest of 2024. Depending on a client’s situation, we are rebalancing equity exposure, if it can be done with minimal tax consequences. We recommend that clients move their equity levels closer to neutral and use the proceeds to invest in short-term bonds.

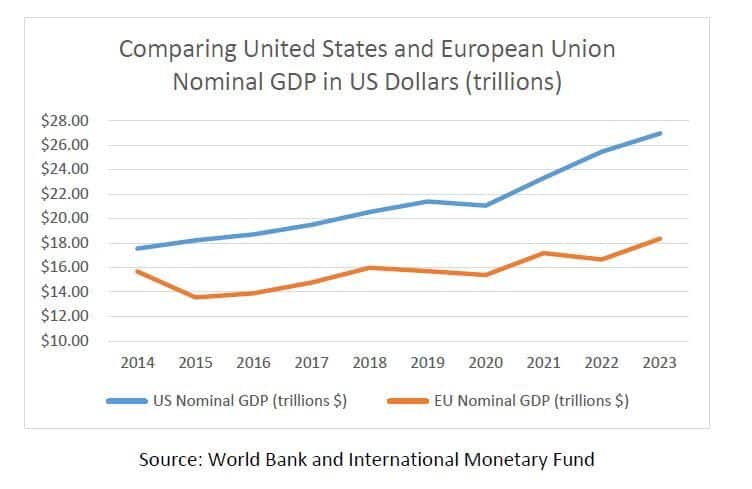

At Virtue Asset Management, we continue to recommend overweighting US equities versus non-US equities. In 2014, the nominal Gross Domestic Product (GDP) of the US was $17.55 trillion. In 2023, the nominal GDP for the US was $26.95 trillion. This is an annual growth rate of approximately 4.4%. Fortunately, the S&P 500 is composed of the best US public companies. From 2014 to 2023, the earnings of the S&P 500 have risen at an annual rate of approximately 7%. In 2014, the European Union had a nominal GDP of $15.65 trillion. In 2023, the nominal GDP of the European Union was $18.35 trillion. This is an annual growth rate of approximately 1.6%. The MSCI EAFE (Europe, Asia and Far East) Index is considered the benchmark for non-US equities and is composed of approximately 70% European companies. From 2014 to 2023, the MSCI EAFE Index has returned 4.24% a year. During that same period, the S&P 500 Index returned 12.03% a year. We still think the US is the best country to start a new company. The regulatory environment, including corporate taxes, is much better in the US than in Europe. Unfortunately, we have seen several portfolios at other advisors that are heavily weighted to non-US equities. For example, the Vanguard 2040 retirement fund has approximately 38% of equities in non-US equities. The Fidelity 2040 retirement fund has approximately 46% of equities in non-US equities.

At the beginning of the year, futures prices implied a total of six rate cuts (.25% each) by the Federal Reserve. Currently, the futures prices imply a total of three rate cuts to a range of 4.5% to 4.75% which matches the current Federal Reserve dot plot projection. These changed expectations affected the yield curve. At the beginning of the year, the 10-year Treasury bond was paying 3.95% and at the end of the quarter, the 10-year Treasury bond was paying 4.20%. The increase in interest rates drove the Bloomberg US Aggregate Bond Index down -.78% for the quarter. At the beginning of the year, we warned that the market had priced in too many interest rate cuts. With a strong economy, stock market and inflation remaining above the 2% target, we believe the Federal Reserve will be cautious in cutting rates in 2024. We recommend clients with cash purchase short-term bonds and wait for a better opportunity to buy bonds with longer maturities.

The commercial real estate market continues to be a risk to the economy and the stock market. According to Moody’s Analytics in Commercial Mortgage Back Securities (CMBS) the amount of maturing office loans has doubled, from $8.7 billion in 2023, to $17.4 billion over the next 12 months. They expect a modest improvement in the payoff rate, from 35% in 2023 to 40-45% in 2024. In total, the failed maturities in 2024 are likely to exceed the entire balance of maturities in 2023, which was $8.7 billion. If Moody’s Analytics is correct, this would leave approximately $10 billion of CMBS office loans searching for a resolution. At Virtue Asset Management, we continue to expect commercial real estate prices to hurt private investors and smaller banks. We recommend underweighting bank stock exposure in general and favor larger banks over smaller banks. We think it is too early to start buying assets overly exposed to office commercial real estate.

In 2024, earnings for the S&P 500 Index are estimated to be $240 a share. This is a price to earnings (P/E) ratio of 21.87. Over the last ten years, the forward P/E has averaged 21.08. Comparing these metrics, we consider the S&P 500 to be fairly valued because the current P/E is slightly higher than the 10-year average. Analysts are estimating earnings in 2025 to grow at approximately 14% to $274. If these estimates are correct, we would expect the S&P 500 to significantly outperform fixed income through 2025. The risk is that the earnings estimates are overly optimistic and inflation remains above the Federal Reserve target. Depending on a client’s situation, we are trimming equities if it can be done with minimal tax consequences. We recommend that clients move their equity levels closer to neutral and use the proceeds to invest in short-term bonds.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management