2024 Review and 2025 Outlook

U.S. Equities Shine in 2024 Amid Economic Resilience

2024 marked another robust year for U.S. equities, with the S&P 500 Index delivering an impressive 25.02% return, closing near all-time highs. These strong returns were driven by an economy that successfully achieved a soft landing, avoiding a recession while navigating declining inflation. The fourth quarter brought additional clarity and optimism as the U.S. election concluded with a Republican sweep of the Presidency and Congress. Markets are hopeful that the incoming administration’s agenda of deregulation and tax cuts will spur economic growth and bolster corporate earnings. However, uncertainty remains around which campaign promises will take priority under the Trump presidency. At Virtue Asset Management, we anticipate that forthcoming legislation and executive actions will favor certain industries and companies. As the administration’s priorities come into sharper focus, we plan to adjust portfolios accordingly to align with emerging opportunities and risks. Looking ahead, we expect the Federal Reserve to remain cautious about further interest rate cuts as it continues its efforts to bring inflation closer to the 2% target. For 2025, we foresee heightened market volatility and recommend that clients adjust equity exposure to neutral while raising cash reserves to cover expenses over the next 18 months.

Federal Deficit and Washington Outlook

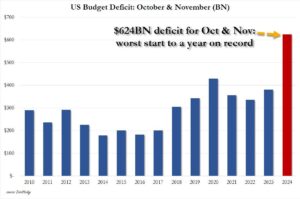

A significant challenge for the new administration is addressing the persistent and accumulated federal budget deficits. As of December 2024, the total U.S. debt reached $36 trillion, with a fiscal year 2024 deficit of $1.8 trillion, despite federal revenues totaling $4.9 trillion. The central issue is how to achieve fiscal balance. Reducing spending could help curb inflation, decrease debt issuance, and lower interest rates. However, nearly half of federal expenditures are tied to Social Security (20%), Medicare (16%), and net interest payments (13%)—categories largely immune to substantial changes without major legislative action. Compounding this challenge, both Social Security and Medicare costs are projected to grow significantly in the future.

The administration also faces the difficult task of reconciling its campaign promises with the existing budget deficit. Proposed measures such as extending the 2017 tax cuts, eliminating income taxes on Social Security, waiving taxes on tips and overtime, fully restoring state and local tax deductibility, and reducing the corporate tax rate to 15% for domestic manufacturers are likely to reduce revenue further. Relying on new tariffs to offset these costs appears improbable without negatively impacting the broader economy and increasing inflation.

Unless significant adjustments are made to Medicare and Social Security, achieving a meaningful reduction in the annual deficit will be extremely challenging. At Virtue Asset Management, we anticipate the administration will prioritize select campaign promises, with specific legislation and executive actions likely to benefit particular industries and stocks. As policy details emerge, we will adjust portfolios accordingly to align with these developments.

Federal Reserve Actions and Bond Market Outlook

In December, the Federal Reserve announced another rate cut, lowering the target range to 4.25%-4.5%. Over the course of the year, the Federal Reserve reduced rates by a total of 1%, down from a high of 5.25%-5.5%. While inflation remains below its post-pandemic peaks, the Consumer Price Index (CPI) rose to 2.7% for the 12 months ending in November—still above the long-term target of 2%. During its December meeting, the Federal Reserve adjusted its outlook, revising its dot plot projection from four 0.25% cuts in 2025 to two 0.25% cuts. Elevated interest rates in 2024 weighed on bond performance, with the Bloomberg Bond Index posting a modest return of 1.25% for the year. The index currently yields approximately 4.5%. Looking ahead, if the new administration can successfully rein in government spending, inflationary pressures may ease, potentially stabilizing or even lowering interest rates. At Virtue Asset Management, we forecast bond returns of 4%-5% for 2025. This would mark a significant improvement for an index that has posted negative returns over the past three- and five-year periods.

Equity Outlook

The increased federal deficit has thankfully not hindered returns for the S&P 500. Over the past 5, 10, and 15 years, the index has delivered impressive annualized returns of 14.53%, 13.10%, and 13.80%, respectively. These strong results continue to be driven by robust earnings growth. For 2024, earnings for the S&P 500 are estimated at $233 per share, equating to a trailing price-to-earnings (P/E) ratio of 25.21. Looking ahead to 2025, analysts project earnings of approximately $271 per share, which brings the forward P/E to 21.68. This figure aligns closely with the 10-year average forward P/E of 21.99.

Applying the 10-year average P/E of 21.99 to the 2025 earnings estimate of $271 yields a target of 5,962 for the S&P 500—only slightly above the current index level. The stock market is forward looking and tends to price in earnings six to twelve months in the future. To achieve larger gains, we would need either higher earnings or an elevated P/E multiple above the 10-year average. For example, a P/E of 24 would set a target of approximately 6,500, representing an 11% increase. Such a scenario could materialize if inflation continues to moderate and the new administration implements pro-business policies.

Given these dynamics, we are selectively trimming equity positions where it can be done with minimal tax consequences. We recommend clients move closer to neutral equity allocations, using proceeds to increase bond exposure.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management