2024 Third Quarter Review and Outlook

In the third quarter, the S&P 500 Index rose by 5.89%, bringing its year-to-date return to 22.08%. This growth was primarily driven by gains in the consumer discretionary, industrial, and utilities sectors. In a somewhat unexpected move, the Federal Reserve cut the federal funds rate by half a percentage point at their September meeting. At Virtue Asset Management, we believe this rate cut has broadened the range of potential market outcomes in both the short and medium term. The rate cut should benefit the housing sector and will reduce individual and corporate borrowing costs and increase corporate earnings. If the economy achieves a soft landing and artificial intelligence (AI) drives earnings growth, we anticipate that the market could continue to rise.

However, if the economy enters a recession or inflation increases beyond current levels, we could see a market pullback of over 10%. Looking ahead, we expect heightened market volatility, particularly with the upcoming U.S. presidential election, where results may be delayed beyond Election Day. Given these uncertainties, we believe equity allocation should be customized to each client’s specific situation. For clients with cash flow needs or portfolios that have already surpassed their goals, reducing equity exposure might be a prudent strategy, especially for clients who are concerned about potential market volatility.

On September 18th, the Federal Reserve reduced the federal funds rate by 50 basis points, lowering the target range to 4.75%–5%. At Virtue Asset Management, we see this move as enhancing the upside potential for equities. The accompanying “dot plot” revealed that the 19 Federal Reserve members, both voting and non-voting, expect the benchmark rate to settle at 4.4% by year-end implying two additional quarter point cuts.

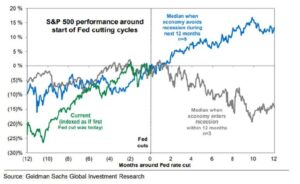

Despite a robust Atlanta Fed GDP estimate of 3.1% and an unemployment rate of 4.2%, the Federal Reserve chose to lower rates. This mirrors historical precedents from 1982 and 1995, when rate cuts during periods of economic strength were followed by significant equity market gains. Research from Goldman Sachs supports this outlook, showing that equities often rally after an initial rate cut—provided no recession is imminent.

Looking ahead, the Fed’s dot plot projects further rate declines, with estimates of 3.4% by the end of 2025 and 2.9% by the end of 2026. The market appears to have already priced in these cuts, pushing equity prices near all-time highs. However, a key risk lies in inflation, which stands at 2.5% (CPI) and 2.3% (PCE). While inflationary pressures are not our base case scenario, they remain a risk factor that could drive market declines and increase volatility. Should inflation unexpectedly rise, the Fed may be forced to halt its rate-cutting cycle—or even reverse course and raise rates—actions that could have significant negative effects on the market.

U.S. large-cap stocks continue to outperform other asset classes, including mid-cap, small-cap, international, and emerging markets. Most equities have also outperformed the Bloomberg U.S. Aggregate Bond Index, which has returned 4.45% year-to-date. At Virtue Asset Management, we continue to recommend an overweight position in U.S. large-cap stocks.

Meanwhile, Chinese equities saw significant movement at the end of September following government efforts to cut interest rates and reserve requirements to stimulate the struggling economy. However, we believe structural challenges in China—such as poor demographics, weak consumer demand, an overbuilt property market and ongoing regulatory crackdowns—will likely keep foreign investors cautious. In our view, companies will need to look beyond China to drive future revenue and earnings growth.

One of the key drivers of market excitement around artificial intelligence (AI) is its potential for exponential growth. AI has the capacity to dramatically improve efficiency, increase revenue at lower costs, and ultimately boost earnings. Companies that successfully integrate AI into their operations could see significant earnings growth in the years ahead. That said, we believe the market is reaching a stage where actual results will need to meet the high expectations currently being set.

As the end of the calendar year approaches, clients should consider several year-end tax and gifting strategies. Clients should consider making charitable contributions to reduce taxable income or gifts to family members or 529 plans to take advantage of the $18,000 annual gift tax exclusion. Finally review your income tax withholding and estimated tax situation to avoid underpayment penalties.

In 2024, earnings for the S&P 500 Index are projected to reach $237 per share, resulting in a price-to-earnings (P/E) ratio of 24. Over the past decade, the average P/E ratio has been 21.61. Analysts forecast earnings growth of over 16% in 2025, bringing estimates to approximately $276 per share. If these projections hold, the market will be trading at a forward P/E of 20.62. Should the P/E revert to the decade average of 21.61, the S&P 500 could approach 6,000, representing a potential 5% appreciation.

Currently, the one-year Treasury yield stands at approximately 4%. For the S&P 500 to outperform Treasuries, it will likely require a combination of strong earnings growth and a higher P/E ratio than we’ve seen over the last decade. For clients with cash flow needs or portfolios that have already met their financial goals, reducing equity exposure may be a prudent strategy, depending on the client’s income tax situation.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management