2025 First Quarter Review and Outlook

A Period of Uncertainty

Stock market volatility in the first quarter surpassed even our elevated expectations. The S&P 500 ended the quarter down 4.29%, after experiencing a correction of nearly 10% from its February 19 peak. This turbulence stemmed largely from uncertainty surrounding the administration’s long-term tariff strategy and its potential effects on inflation and consumer spending. The administration has signaled that short-term market fluctuations are not a primary concern as they pursue broader economic objectives. On March 10, Treasury Secretary Scott Bessent reinforced this stance, stating there is no “Trump put” for the stock market. Instead, the administration remains focused on addressing trade imbalances and reducing the federal deficit. If these efforts lead to favorable trade agreements and disciplined government spending, they could create conditions for positive equity returns over the remainder of the term. However, the April 2 tariffs were higher than anticipated, prompting financial markets to reassess economic assumptions and reprice equities in an environment of rising costs and lower corporate profits. Looking ahead, we anticipate continued volatility and recommend that clients maintain a neutral equity stance until there is greater clarity on tariff policies.

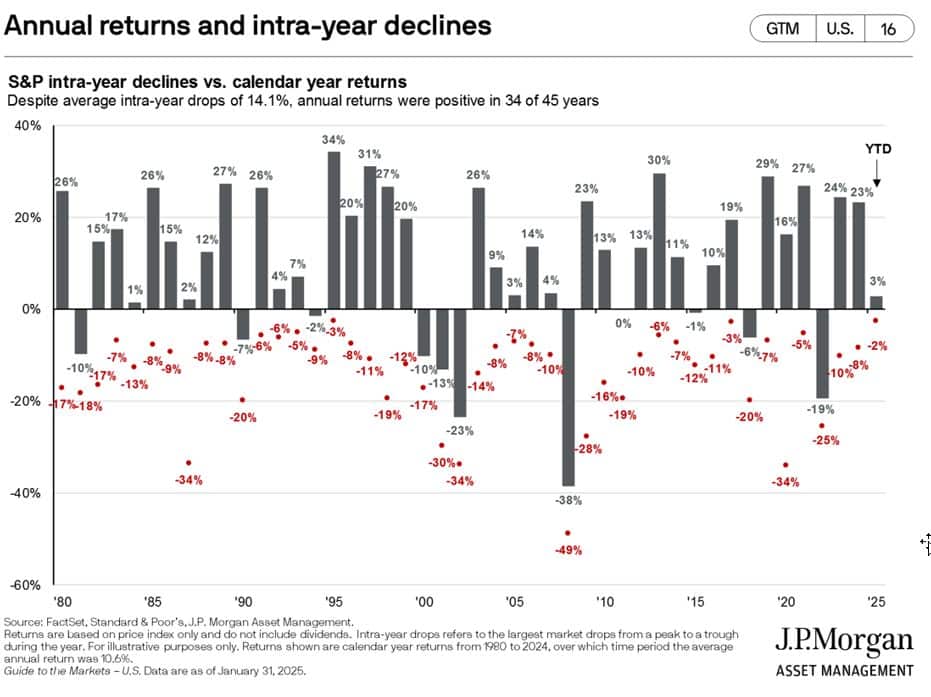

Volatility: The Price of Admission

A 10% correction in the S&P 500 is not unusual. Over the past 45 years, the index has experienced an average intra-year decline of 14.1%, yet it has delivered an average annual price return of 10.6% (excluding dividends). To illustrate, a $10,000 investment in the S&P 500 in 1980 would have grown to approximately $931,000 by the end of 2024—without accounting for dividends. These fluctuations highlight the importance of constructing portfolios aligned with an investor’s risk tolerance and financial goals.

Understanding risk before a downturn helps investors avoid the costliest mistake: panic selling. Given ongoing volatility, we continue to advise clients to maintain sufficient cash reserves to cover expected distributions and liquidity needs over the next 18 months. We remain optimistic about the U.S. economy, which continues to foster entrepreneurship, drive innovation, and create investment opportunities as new businesses go public. While past performance does not guarantee future results, history demonstrates that stock market returns are ultimately driven by earnings growth. Until our outlook shifts, we will maintain our overweight position in U.S. equities relative to international stocks.

Short Term Risks

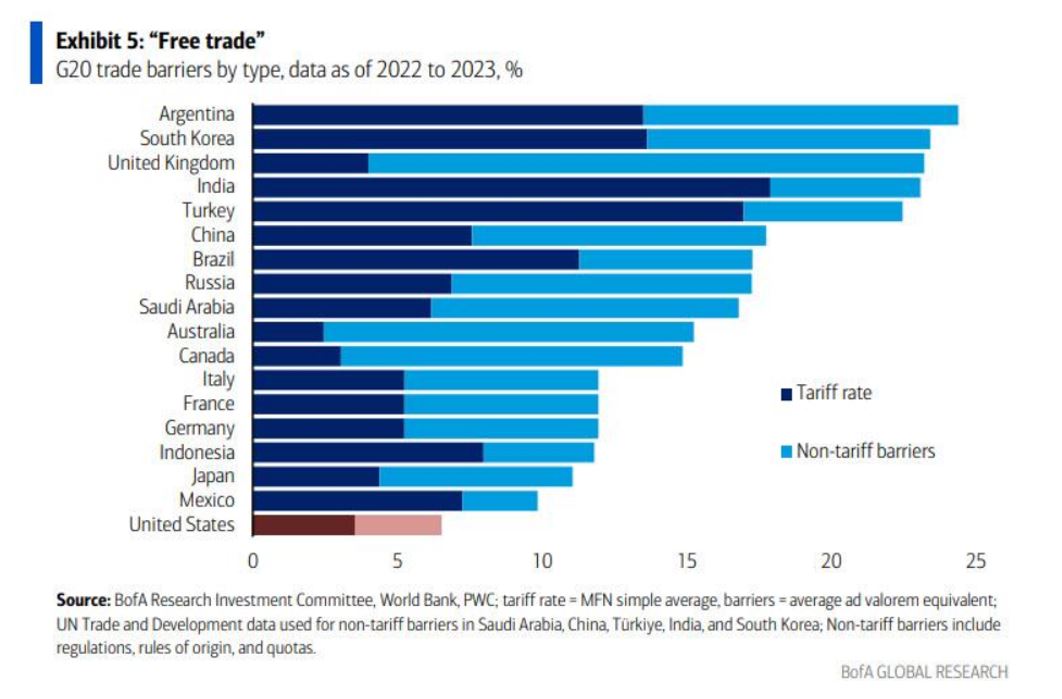

The current administration has brought two major economic concerns into focus: the U.S. trade imbalance with certain countries and rising government deficit spending. On April 2nd, President Trump announced reciprocal tariffs that exceeded most expectations. A report from Bank of America Global Research highlights that the U.S. imposes significantly lower trade barriers than any other G20 nation. However, the study also suggests that global tariff and trade barriers are much lower than the rates the administration used to justify its reciprocal tariffs. At Virtue Asset Management, we believe tariffs offer limited long-term economic and market benefits. While they can be effective short-term negotiation tools, prolonged high tariffs often stifle market growth. As a result, we anticipate continued uncertainty surrounding tariffs over the next quarter or two. From a bullish perspective, these tariffs could serve as leverage to lower trade barriers in other countries, ultimately benefiting U.S. exporters. Conversely, the bearish view warns that retaliatory measures from other nations could drive up costs, slow global economic growth, and weigh on corporate earnings. Notably, the last two presidents failed to secure a second term despite strong stock market performance—suggesting that the current administration may be prioritizing broader economic policies over immediate market gains. With midterm elections approaching, the administration may recalibrate its trade policies to strengthen support for incumbents seeking reelection.

In fiscal year 2024, the U.S. government reported $4.92 trillion in revenue and $6.75 trillion in spending, resulting in a $1.83 trillion deficit. Interest expenses alone totaled $882 billion, with net federal interest payments surpassing defense spending. This creates a vicious cycle—rising debt leads to higher interest costs; particularly as new borrowing demands higher rates. To balance spending, the government would need to increase revenue by 40% – an unlikely scenario given economic and political constraints. We remain highly skeptical that tariffs will significantly reduce this gap. Even if the entire wealth of the 10 richest Americans were confiscated, it wouldn’t cover a single year’s deficit. While criticism of the administration’s fiscal approach is valid, the broader issue remains: the country must engage in serious discussions about spending cuts and fiscal responsibility. Achieving a balanced budget will require difficult choices about which programs to reduce or eliminate. In the short term, reduced government spending may pressure markets, but in the long run, it could lay the groundwork for economic stability, curb inflation, and foster sustainable growth.

Earnings: The Market’s Driving Force

Historically, S&P 500 returns have closely followed earnings growth. Current projections estimate that S&P 500 earnings will rise approximately 7% to $267 in 2025, translating to a forward P/E ratio of 21.3 – nearly identical to the 10-year average of 21.29. Based on these metrics, the market appears fairly valued at this stage. As a forward-looking mechanism, the stock market will gain greater clarity in the coming quarter regarding the economic trajectory of the U.S. If tariffs remain in place through Q2, they could put downward pressure on equities. However, if tariffs are temporary and the administration successfully curtails spending, it could set the stage for renewed market growth. Given the current uncertainty, we continue to recommend a neutral stance and advise clients to seek opportunities to raise cash for any upcoming liquidity needs.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management