When we think of wealth, we often picture sizable assets: a large home, a growing investment portfolio, or perhaps a collection of valuable assets. But do these assets alone equate to true financial wealth? While assets are a core part of wealth, they don’t tell the whole story. True wealth encompasses much more than what’s easily quantifiable, including financial security, freedom, and peace of mind. Drawing on our experience helping clients achieve lasting financial stability at Virtue Asset Management, we explore the relationship between assets and wealth to show why understanding the difference is essential for true financial well-being.

Defining Assets and Financial Wealth

Assets are essentially what we own, such as real estate, stocks, bonds, cash, collectibles, and other tangible or intangible items of value. They can fall under these classes:

- Liquid Assets: Easily converted to cash, like savings or stocks, liquid assets offer flexibility in times of need.

- Illiquid Assets: Real estate or collectibles that may take time to sell but contribute to long-term value.

- Tangible vs. Intangible Assets: Tangible assets include physical items like property, while intangible assets might include intellectual property or goodwill.

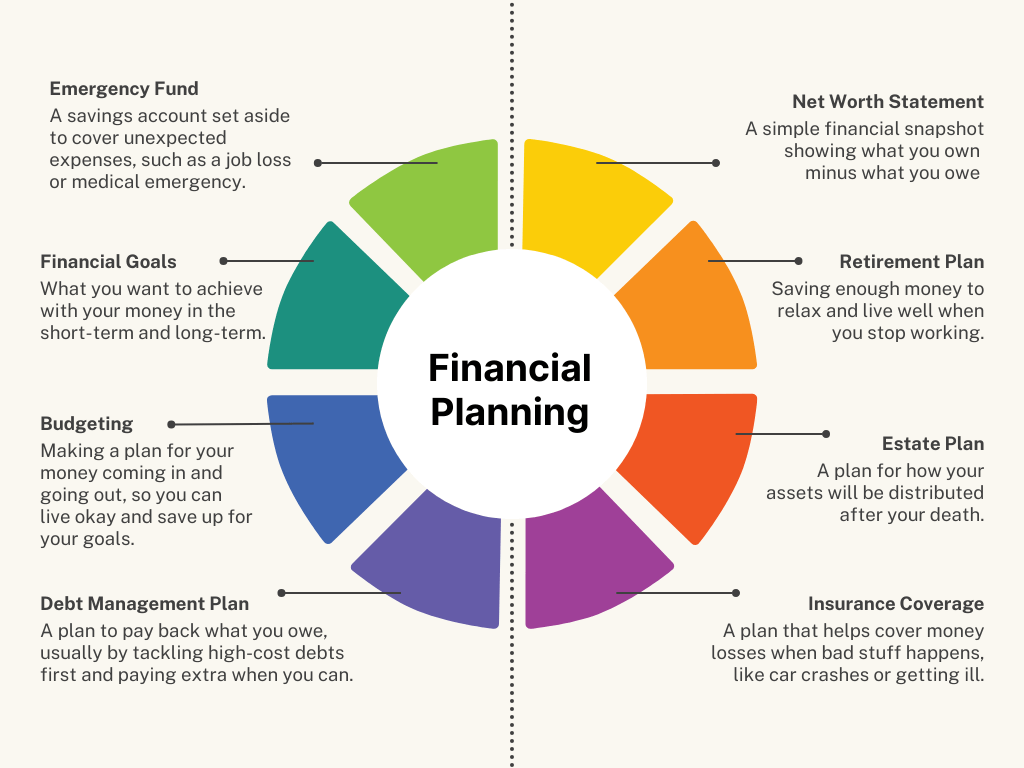

Financial wealth considers not only assets of these classes but also liabilities, debts, and other intangible variables. Liabilities, such as mortgages, loans, and credit card debt, reduce net worth by offsetting asset values. True financial wealth, therefore, is about the strength of net worth rather than just asset accumulation.

It’s also essential to understand the difference between income and wealth. A high income doesn’t always mean one is wealthy if their liabilities are equally high or if most of that income is spent rather than saved or invested. True wealth often results from managing assets, liabilities, and income wisely.

Beyond Dollar Value: The Qualitative Side of Wealth

Wealth is more than just a collection of assets; it includes the freedom, stability, and ability to pursue financial goals without constant worry. Net worth (assets minus liabilities) is a useful starting point, yet two people with similar net worth may experience wealth differently based on income stability, debt levels, and financial flexibility.

As entertainer Chris Rock noted, “Wealth is not about having a lot of money; it’s about having many options.” This captures the idea that true wealth offers choices and the ability to make decisions without being constrained by financial obligations. For example, a person with a modest income, strong savings, and low debt may feel wealthier than someone with a high income but significant financial obligations.

In financial planning, the qualitative side of wealth is essential because it creates a sense of security and reduces financial stress. Virtue Asset Management is your trusted financial planner, with a fiduciary duty to put your interest first and align wealth planning with financial stability and your personal goals. Some people might prioritize having cash reserves to handle unexpected expenses, while others feel more secure with a diverse investment portfolio that supports long-term growth. Personal preferences, financial goals, and risk tolerance all shape an individual’s wealth experience, underscoring the importance of a well-rounded, customized approach to financial planning.

Financial Planning Implications

Building a solid financial plan means incorporating both asset growth and wealth strategies. Asset allocation maximizes returns across a balanced portfolio, while wealth management emphasizes sustained growth, risk management, and resilience.

At Virtue Asset Management, our fiduciary advisors take a stepwise approach that begins with an initial consultation to understand each client’s background, goals, and risk tolerance. We assess the current financial situation, clarify specific financial goals, and establish time horizons for a tailored investment plan. This process is formalized in an Investment Policy Statement (IPS), and we conduct regular reviews to adjust as needs or market conditions change.

If you’re seeking a certified financial planner near me to create a plan that truly aligns with your needs, consult with Virtue’s experienced team to ensure every aspect of your wealth strategy is optimized.

Measuring Financial Wealth

True financial wealth goes beyond asset value alone. Key measures include net worth (assets minus liabilities) and liquidity- the portion of assets, like cash or stocks, readily accessible to cover immediate needs. Equally important is the debt-to-asset ratio, which indicates how much of your assets are offset by liabilities; a lower ratio generally reflects greater financial stability.

Diversified income sources such as investments, rental income, or dividends also offer resilience against market shifts, supporting long-term financial security. If you’re seeking a financial planner near me for personalized wealth-building strategies, our team provides personalized guidance to align your financial plan with your unique goals, helping to secure stability and growth through every market cycle.

Virtue Asset Management: Guiding You to Real Financial Wealth

At Virtue Asset Management, we recognize that true wealth goes beyond simply accumulating assets; it’s about creating a financial future that aligns with your personal vision of success. Our certified advisors work with clients to build sustainable wealth by balancing asset growth with preservation strategies that fit each individual’s unique needs. If you’re seeking a certified financial planner near me, our team understands the intricate relationship between assets, liabilities, and income, and how these elements come together to create financial freedom. Whether you’re just beginning your financial journey or are focused on long-term wealth management, Virtue Asset Management is here to help you achieve what your picture of wealth truly looks like.