Hedging Low-Cost Basis Stock Using Options

Using options for a low-cost basis concentrated position involves leveraging options to manage risk and potentially enhance returns. Writing a call option and buying a put option are two different strategies used in options trading, each with its own objectives and risks. Here’s a detailed explanation of each:

Writing a Call Option

Writing (Selling) a Call Option:

- Objective: Generate income from the premium received.

- Mechanics: When you write a call option, you give the buyer the right to purchase an underlying asset (like a stock) from you at a predetermined price (the strike price) within a specified period (until the expiration date).

- Premium: The buyer pays you a premium for this right.

- Obligation: You are obligated to sell the asset at the strike price if the buyer exercises the option.

Possible Scenarios:

- If the asset price stays below the strike price:

- The option expires worthless.

- You keep the premium as profit.

- If the asset price rises above the strike price:

- The buyer exercises the option.

- You must sell the asset at the strike price.

- Your profit is limited to the premium received, and you may incur a loss if the asset’s market price is significantly higher than the strike price.

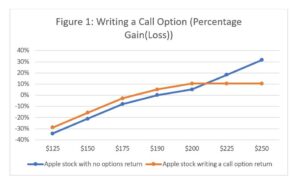

Example:

- You own shares of Apple stock currently trading at $190.

- You write a call option with a strike price of $200, expiring in six months, for which you receive a $10 premium per share.

Outcomes:

- Stock stays below $200: The option expires worthless. You keep the $10 premium.

- Stock rises to $250: The option is exercised. You sell at $200, but effectively at $210 per share (considering the $10 premium), even though the market price is $250.

Buying a Put Option

Buying a Put Option:

- Objective: Hedge against a decline in the price of an asset or speculate on a decline.

- Mechanics: When you buy a put option, you acquire the right to sell an underlying asset at a predetermined price (the strike price) within a specified period (until the expiration date).

- Premium: You pay a premium to the seller of the put option for this right.

- Right: You have the right, but not the obligation, to sell the asset at the strike price.

Possible Scenarios:

- If the asset price stays above the strike price:

- The option expires worthless.

- Your loss is limited to the premium paid.

- If the asset price falls below the strike price:

- You can exercise the option to sell the asset at the higher strike price.

- This allows you to limit your losses or profit from the decline in the asset’s price.

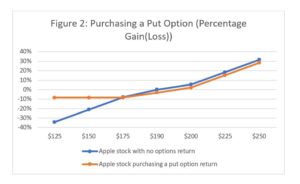

Example:

- You own shares of Apple stock currently trading at $190.

- You buy a put option with a strike price of $180, expiring in six months, for which you pay a $6 premium per share.

Outcomes:

- Stock stays above $180: The option expires worthless. Your loss is the $6 premium.

- Stock falls to $150: You exercise the option. You sell at $180, effectively limiting your loss to the difference between $190 and $180 (minus the $6 premium).

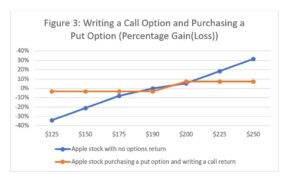

Combined Strategy: Collar Strategy

Sometimes, investors use a combination of these strategies to manage risk. For instance, you might own a stock, write a call option (covered call) to generate income, and simultaneously buy a put option (protective put) to hedge against potential losses. This strategy combines the income from the call premium with the downside protection of the put. You generate income from the call premium while the put option protects against significant downside risk.

Example:

- You own shares of Apple stock currently trading at $190.

- You write a call option with a strike price of $200, expiring in six months, for which you receive a $10 premium per share.

- You buy a put option with a strike price of $180, expiring in six months, for which you pay a $6 premium per share.

Outcomes:

- Stock rises to $250: The call option is exercised. You sell at $200, but effectively at $204 per share (considering the $10 premium written and $6 premium paid), even though the market price is $250.

- Stock stays at $190: The options expire worthless. Your gain is the $4 premium (the $10 premium written and the $6 premium paid).

- Stock falls to $150: You exercise the put option. You sell at $180, effectively limiting your loss to the difference between $190 and $180 (plus the $4 premium).

Summary

- Writing a Call Option: Generates income through the premium, with the obligation to sell the asset at the strike price if exercised. The risk is potentially selling the asset at a lower price than the market price.

- Buying a Put Option: Provides the right to sell the asset at the strike price, offering downside protection. The risk is limited to the premium paid if the option expires worthless.

- Creating a Collar Strategy: When combining both strategies—writing a covered call and buying a put—you create what is known as a “collar” strategy. The premium from the covered call partially offsets the cost of the put, providing a cost-effective way to hedge the position. Your maximum loss is limited to the difference between the stock purchase price and the put strike price, minus the net premium received.

These strategies can be part of sophisticated trading and risk management plans. It’s crucial to fully understand the mechanics and risks involved before engaging in options trading. Option strategies involve risk and are not suitable to all investors. Before investing in options, investors should consider their investment objectives, risk tolerance and financial resources. Consult an investment professional before investing in options.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management