Market Update

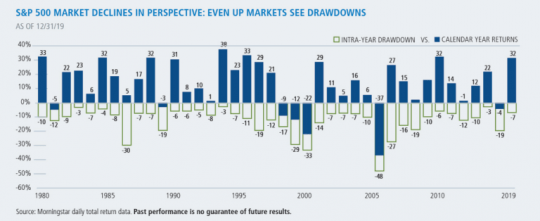

In our year end letter, we cautioned that clients should be emotionally prepared for a decline of close to 20%. Due to a risk that was so unexpected that it wasn’t even considered a possibility the market has dropped over 20% for the year. The decline has been caused by the uncertainty created by the coronavirus. A double-digit decline is not uncommon for the S&P 500, even in years of positive returns (see chart below). When we discuss the risk of stocks, we like to remind clients that the market dropped 22% in one day in 1987 and dropped nearly 50% during the 2001-02 period and the 2008-09 period. Therefore, when people create portfolios, we recommend having exposure to fixed income based on their risk/reward profile. Fixed income provides a source of funds to cover upcoming expenses in these periods of extreme drawdowns. Fixed income also provides funds to add to the stock market during a drawdown.

Source: Calamos Investments

This pullback resembles the 2008-09 period in some respects. In 2008, the housing bubble was in the process of bursting. At the beginning, it was unknown how negatively it would impact the overall economy. The government created more uncertainty when it bailed out Bears Sterns (allowing it to be purchased by JP Morgan) but let Lehman Brothers go bankrupt. Adding to the uncertainty, Congress initially rejected the Emergency Stabilization Act of 2008. The day that Congress rejected the bill, the market dropped 7%. Currently, it is unknown how severely and for how long the coronavirus will impact the overall economy. However, the market is looking for a coordinated response. The market wants a response that will give clarity on the health care side, the financial side and a better idea when we can plan to return to normalcy.

The stock market, just like a business owner, wants clarity in order to predict future cash flows. At first, the worry was that the coronavirus was only going to disrupt the global supply chain. Using Apple as a proxy for the overall market, the virus meant that Apple might not be able to supply all the iPhones needed to meet global demand. The next issue was that the mass quarantine in China would decrease demand for the iPhone. As a reminder, Apple generated over $33 billion in iPhone sales in the fourth quarter of 2019. As the virus has spread throughout the world it becomes harder to project both the short- and long-term effects. For Apple, it becomes harder to project how many phones will be sold in the next quarter and the next year. With the current decline, Apple has lost over 300 billion in market cap (that is close to 10 quarters of iPhone sales). Eventually, Apple will have another quarter of $33 billion in iPhone sales. The main question is how long it will take for sales to rebound.

This is where the market is looking at the administration to provide a game plan. The market wants some clarity on how long this virus will probably last. The market wants solutions to provide help for workers who will lose income and businesses who will lose sales. The administration has been slow to roll out a plan that addresses these concerns. Therefore, the markets first instinct is to sell and ask questions later. On March 12th, we continue to see partisan comments from Congress. This lack of action reminds me of the rejection of the Emergency Stabilization Act of 2008 by Congress. Instead of reassuring the market with a plan, it increased the uncertainty. Apple, the US economy and the stock market will survive this and eventually thrive. However, we don’t recommend becoming aggressive buyers of stocks until the administration provides a detailed plan with the support of Congress.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management