May Market Update

Stocks have fallen sharply this year and are now in a correction due to concerns about inflation and Federal Reserve monetary policy. On May 11th, the Consumer Price Index (CPI) for April reported an 8.3% increase year over year. This was higher than analysts’ expectations of 8.1% but a slight decrease from the 8.5% increase in March. Inflation is much higher than Federal Reserve’s predictions made in 2021. When making those predictions the Federal Reserve did not know that Russia would invade Ukraine and that China would shut down some of their largest cities in their pursuit of a zero covid policy. These events have contributed to rising prices on oil, food and continued global supply chain issues.

The financial markets are predicting that the Federal Reserve will have to raise interest rates faster and higher than forecasted. Most of these future rate increases are already priced into the financial markets. The 2-year Treasury yield has risen from .73% at the end of last year to 2.74%. The Federal Reserve would have to raise interest rates four times at 50 basis points to get to this level. The 10-year Treasury yield has increased from 1.52% to 2.99%. Uncertainty abounds whether higher rates may lead to a recession in 2023.

Unfortunately, the Federal Reserve tools have provided little help regarding Ukraine or China. It doesn’t seem prudent for the Federal Reserve to deviate from their plan of 50 basis point hikes at the next few meetings. Raising interest rates sooner and higher than previously signaled will have minimal effect on the supply chain issues due to the war in Ukraine and the shut down in China

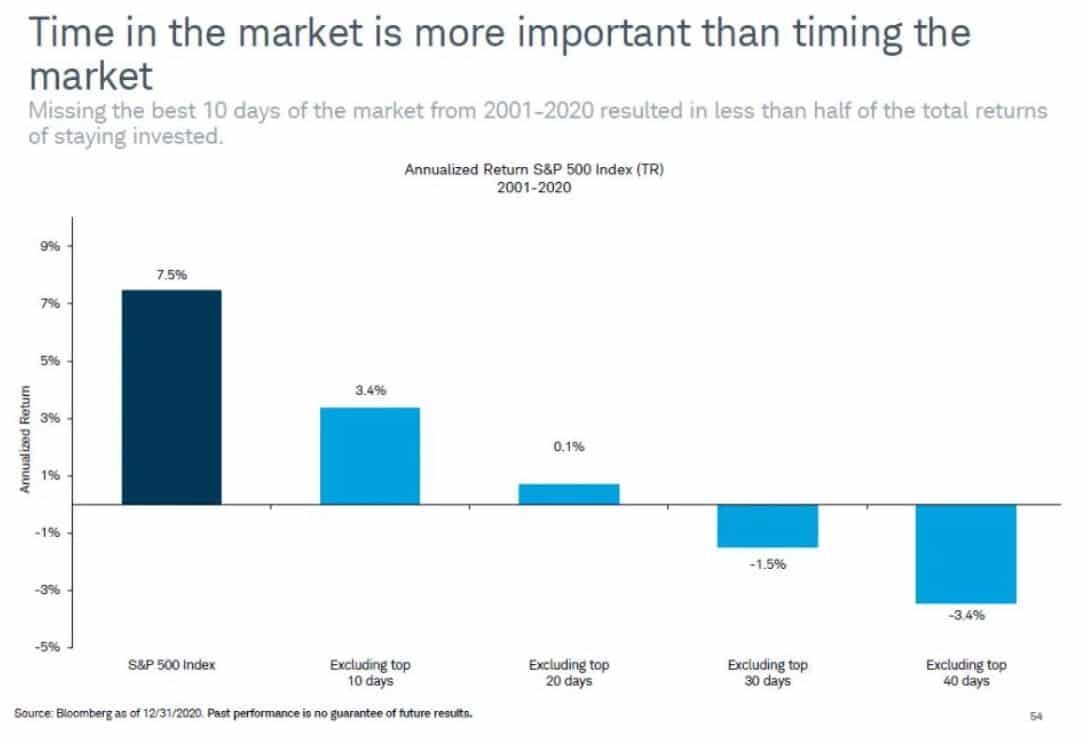

Investors might be tempted to sell equities and sit on the sidelines. Timing the market can dramatically reduce performance. If an investor missed the top 10 days in the market from 2001 to 2020 their annual return was 3.4% versus 7.5%. China could adjust their zero covid policy, at a moment’s notice, and that would be bullish for stocks. Once China starts to open back up, that potentially could reduce the global supply chain issues and help push inflation lower. It seems less likely that Russia will pullback from Ukraine in the short term. However, low morale, poor logistics and sanctions could make a prolonged war difficult. Once the war in Ukraine is over, we expect inflation to decrease. This is why we advised clients to have three to five years of upcoming expenses in safe and short-term maturity bonds to avoid selling stocks during market pullbacks. Time in the market is more important than timing the market.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection, and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives, and tolerance for risk.

Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management