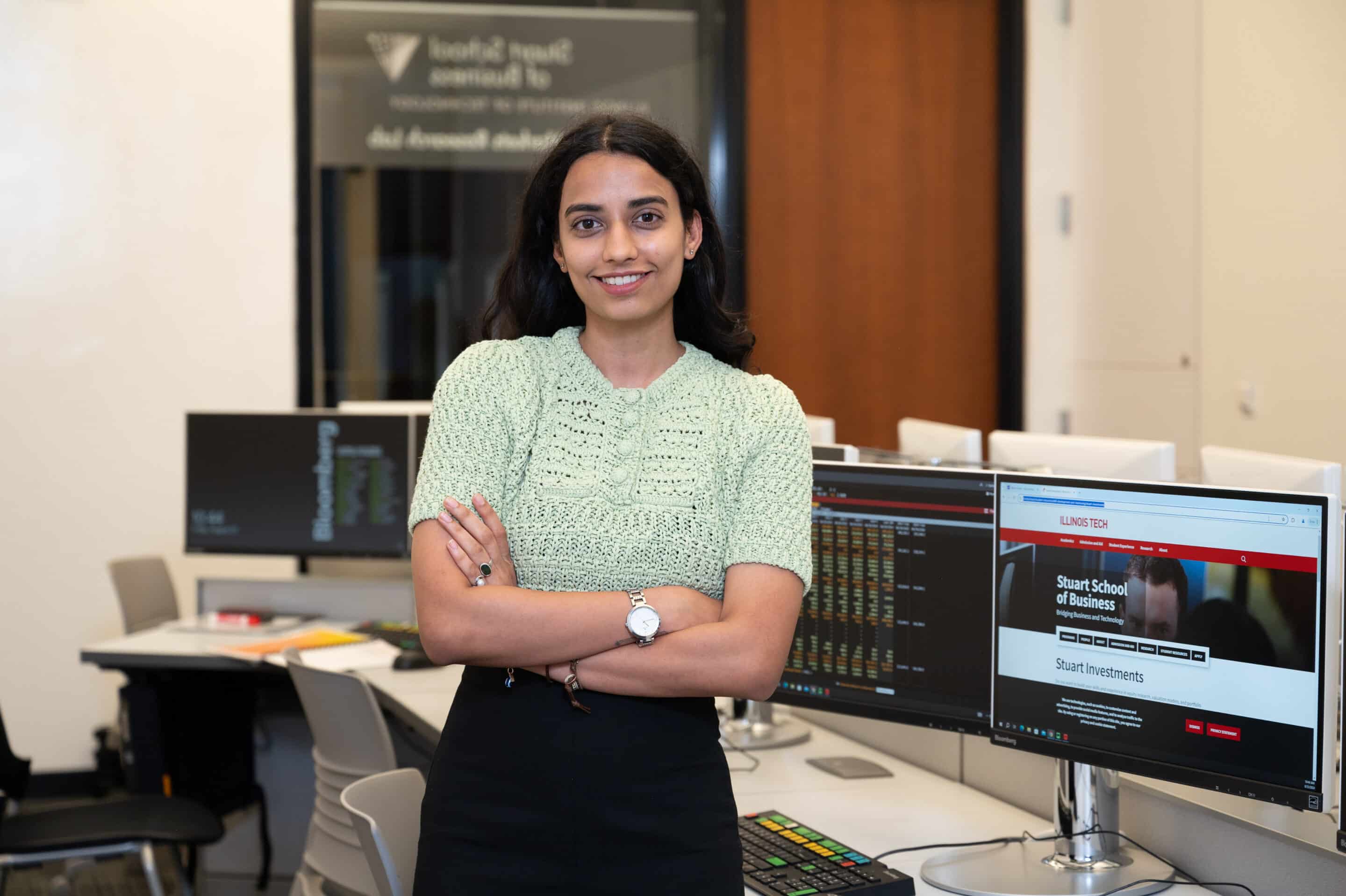

Meet Our Spring Intern: Akansha Burad

Please write a short biography about yourself.

I am a finance professional driven by curiosity, continuous growth, and a passion for strategic investing. Currently, I am pursuing my Master of Science in Finance at the Illinois Institute of Technology. I am committed to deepening my financial expertise and expanding my knowledge in the related vicinity, and for this reason I am pursuing CFA.

My journey in finance has been shaped by a strong analytical mindset, a hunger for thoughtful ideas, and a desire to explore innovative investment strategies. At Stuart Investments, I managed a $1.8M portfolio, conducted in-depth equity research, and developed valuation models to optimize investment decisions. I also founded Elite – The Learning Academy, where I mentored students in accounting and financial principles—an experience that reinforced my passion for knowledge-sharing and leadership.

Beyond technical skills, I thrive on meaningful conversations and networking with like-minded professionals. I believe that great ideas emerge from diverse perspectives, and I actively seek opportunities to engage with thought leaders in finance and beyond. My participation in the McGill International Portfolio Challenge, where my team advanced to the semifinals, challenged me to analyze complex financial scenarios and develop innovative solutions.

At Virtue Asset Management, I am excited to apply my expertise, learn from experienced professionals, and contribute to wealth management strategies that create long-term value. I see every challenge as an opportunity to grow, and my relentless drive ensures that I stay ahead in the ever-evolving world of finance.

Can you tell about your educational background and why you chose your major?

I have always been fascinated by the power of financial decision-making and its impact on businesses, economies, and individuals. From an early age, I was curious about how money flows within an economy, how economic events shape corporate strategies, and how they influence the stock market. I wanted to understand the reasoning behind financial decisions, the factors that drive investment strategies, and the interplay between economic policies and market movements.

My academic journey began with a Bachelor of Commerce in Accounting from Pt. Ravishankar Shukla University in India, where I developed a strong foundation in financial principles, accounting, and analytical reasoning. While studying, I became increasingly interested in the broader world of finance beyond traditional accounting—particularly how financial markets function and how businesses make strategic decisions in response to economic changes.

To further deepen my expertise, I pursued a Master of Science in Finance at the Illinois Institute of Technology, where I have refined my skills in financial modeling, risk management, investment analysis, and portfolio strategy. Meeting professors and learning from their experiences has significantly shaped my thinking, offering new perspectives on how financial theories are applied in the real world. Their insights have helped me develop a more nuanced approach to problem-solving and strategic decision-making.

Additionally, as a CFA Level 1 candidate, I am continuously expanding my knowledge in asset valuation, ethical investing, and global financial markets. Studying finance has not only enhanced my technical skills but also strengthened my ability to analyze complex financial scenarios, adapt to evolving market trends, and think critically about investment opportunities.

I chose finance as my major because I thrive on solving complex problems, making data-driven decisions, and uncovering insights that drive financial growth. Finance is not just about numbers—it’s about strategy, psychology, and understanding market dynamics. My passion for this field is fueled by my eagerness to explore thoughtful investment ideas, engage in meaningful discussions, and continuously evolve in an ever-changing financial landscape.

What classes or projects have you found most engaging and why?

One of the most engaging projects I have worked on is “Strategic Thinking in FP&A,” where I explored key financial planning and analysis (FP&A) concepts that drive strategic decision-making. Beyond projects, I have found my Asset Valuation and Corporate Finance classes particularly engaging. These courses and projects have significantly shaped my critical thinking, analytical skills, and strategic mindset—all of which are essential for a successful career in finance.

What sparked your interest in Investment management?

My interest in investment management was sparked by my curiosity about how capital flows within markets, how economic events influence asset prices, and how strategic investment decisions create long-term value. I was fascinated by the interplay of risk and return, the psychology of market movements, and the impact of financial strategies on corporate growth.

I enjoy the challenge of identifying undervalued assets, optimizing portfolios, and making data-driven investment decisions that drive financial success.

What do you hope to learn or accomplish during your time with Virtue Asset Management?

During my time at Virtue Asset Management, I hope to gain hands-on experience in wealth management, investment research, and portfolio optimization. I aim to refine my financial analysis skills, understand client-driven investment strategies, and deepen my knowledge of market trends.

Additionally, I look forward to networking with seasoned professionals, learning from their experiences, and enhancing my strategic thinking in investment management. My goal is to contribute meaningfully to the team while expanding my expertise in asset allocation and risk management.

What do you like to do in your free time do you have any interests or hobbies?

I enjoy practicing yoga as it helps me build mindfulness, discipline, and overall well-being. I am constantly working on improving my techniques and deepening my understanding of its physical and mental benefits. I have also started to develop an interest in tennis and try to make time for it each week. I also have a passion for reading books, as it allows me to explore new ideas, gain different perspectives, and continuously learn.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management