Stocks Offer the Potential for Appreciation and a Good Source of Growth in Income for Long-Term Investors

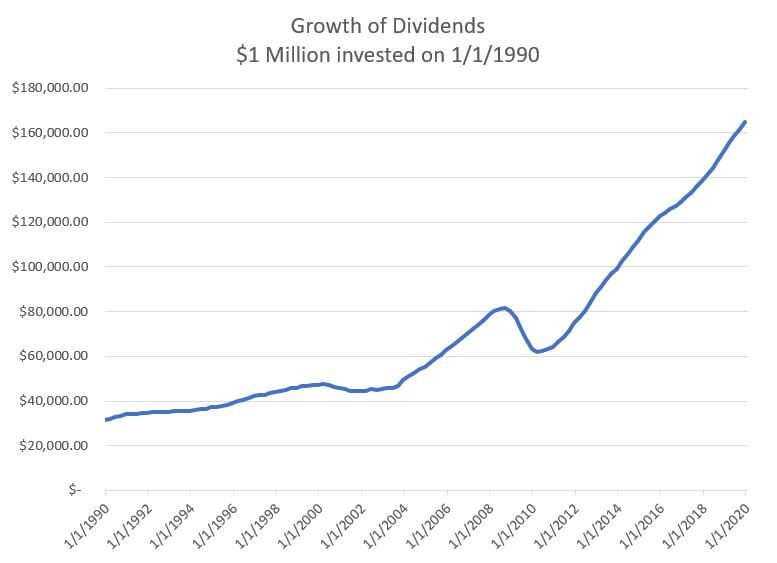

Historically common stocks have provided excellent growth in income. Most investors understand that stocks provide the opportunity for long-term capital gains, but they ignore the potential for growth in dividends over time. For example, $1 million invested in the S&P 500 Index at the end of 1989 would have grown from $9,141,000 at the end of 2019. The dividends generated from the portfolio would have increased from $31,300 to $164,800 at the end of 2019.

Stocks Provide Real Growth Over Time

The primary reason to invest in common stocks is the potential for long-term growth as corporations increase their earnings over time. Historically common stocks have provided a total return that exceeds the rate of inflation, providing investors with real inflation adjusted growth. Total return is comprised of two components, price appreciation and cash flow. According to Bloomberg, the average annual total return for the S&P 500 Index for the thirty-year period ending on December 31, 2019 was 9.94%. Excluding dividends, the price appreciation was 7.76% per year. This means that $1 million invested in the S&P 500 Index on December 31, 1989 would have grown to $9,141,000 at the end of 2019, assuming that dividends were taken in cash and not reinvested back in the portfolio. During the same time period the rate of inflation increased by an average of 2.29% per year.

Stocks Offer a Good Source of Cash Flow

In addition to providing the opportunity for long-term growth, investing in stocks can also provide a steady stream of income through quarterly dividend payments. Currently, according to Standard & Poor’s, the S&P 500 Index has a dividend yield of 1.95%. This compares favorably to the current yield on a 10 Year U S Treasury bond of approximately 0.80%. Interest rates on bank deposits, CDs and bonds are at or near all-time lows and are expected to remain depressed for the foreseeable future due to low inflation and accommodative central bank monetary policy.

Growing Cash Flow Faster Than Inflation

Even more important than the current yield, is the potential for growth in dividends as corporations grow their earnings over time. Since 1990 companies in the S&P 500 Index have increased their dividends by an average of 5.7% per year according to Standard & Poor’s. This means that cash flow from dividends increased by over twice the rate of inflation, providing real cash flow growth to stock investors. Over time, the compounding of this dividend growth becomes powerful. As shown above, the annual dividends on $1 million invested in the S&P 500 Index on December 31, 1989 would have grown from $31,300 to $164,800 at the end of 2019.

It’s What You Keep After Taxes That Counts

Dividends also receive favorable federal income tax treatment. Wages and interest are subject to ordinary federal income tax rates as high as 37%. Qualified dividends are subject to federal tax rates of 0%, 15% and 20%, depending on income and tax filing status, plus a 3.8% Net Investment Income Tax surcharge for married taxpayers with incomes over $250,000. For example, many married couples with modified adjusted gross income under $496,599, pay an 18.8% federal income tax on their dividend income.

Have a Long-term Investment Plan

Investing in common stocks provides the opportunity for growth in principal and income over time. In the short-term stock prices can be very volatile. Since 2000 investors have experienced market declines of 35% or more on three separate occasions. Investors need to determine the long-term asset allocation between stocks, bonds and cash that is appropriate given their risk tolerance, cash flow needs, time horizon, tax situation and other sources of income. Virtue Asset Management has the experience and financial planning tools to help investors by preparing a customized financial plan and asset allocation recommendation designed to achieve their specific long-term financial goals. We also have the expertise to construct a diversified portfolio of individual common stocks and bonds consistent with their needs. Please contact Virtue to arrange a financial review to determine if your current investment portfolio is appropriate.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk.

Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management