Treasury Inflation Protected Securities – An Attractive Option to Diversify Your Bond Portfolio

Fixed income securities play an important role in most client portfolios. They provide cash flow, diversification and reduced volatility. Federal Reserve policy designed to stimulate the economy has created a low interest rate environment and made fixed income investing more challenging. At Virtue Asset Management we utilize a variety of options to construct fixed income portfolios for our clients. These options include traditional investment grade bonds, preferred and convertible securities, closed end and emerging market bond funds. Treasury Inflation-Protected Securities (TIPs) are another attractive fixed income investment.

TIPs are Treasury securities issued by the U.S. government where the principal value is indexed to inflation to protect investors from a decline in purchasing power over time. As inflation rises, the principal value of a TIP is adjusted up. For example, an investor purchases a $100,000 TIP with a coupon rate of 1%. If inflation, as measured by the Consumer Price Index (CPI) rises by 2%, the principal will be adjusted upward to $102,000. The coupon rate will remain the same at 1%, but it will be multiplied by the adjusted principal amount to arrive at an interest payment of $1,020 for the year.

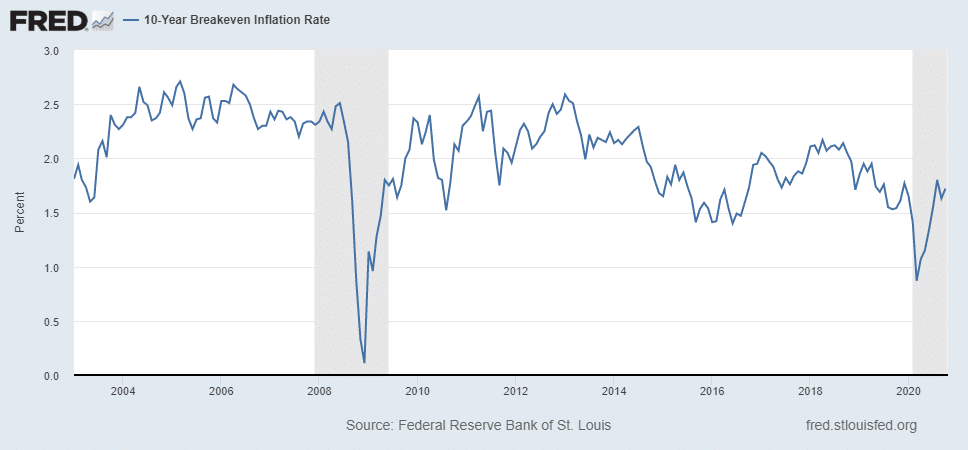

TIP’s usually pay lower interest rates than traditional Treasury notes. The difference in the yield to maturity between the TIP and the traditional Treasury note is called the breakeven rate or the implied inflation rate. The breakeven rate, which is currently 1.7% on a ten-year TIP, is the average inflation rate that investors expect over the life of the bond. Since 2003 the breakeven rate has averaged just above 2%. If the actual CPI exceeds the breakeven rate, then the TIP will provide a greater investment return than the traditional Treasury note.

TIP’s are an attractive investment opportunity due to a recent change in Federal Reserve policy. In August 2020, Federal Reserve Chairman Jerome Powell announced a long-term inflation target for the economy. He indicated a willingness to allow inflation to exceed the target to offset a period of low inflation. The Fed’s August 27, 2020 announcement stated: “The Committee seeks to achieve inflation that averages 2% over time and therefore judges that, following periods where inflation has been running persistently below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time.”

Most investors are familiar with the adage “don’t fight the Fed.” Over the past decade, inflation has consistently run below the Fed’s 2% inflation target due to slow population growth, new technologies and globalization. This has not always been the case. During the 1970’s inflation averaged over 7% per year. Current large coronavirus stimulus efforts and persistent budget deficits may lead to greater inflation in the future. Based on the current breakeven rate combined with the Federal Reserve’s desire to increase inflation we believe TIP’s currently provide an excellent opportunity for investors.

At Virtue asset management most fixed income portfolios will still emphasize high quality investment grade corporate and municipal bonds. We are also utilizing TIPS’s to provide for higher returns and a hedge against rising inflation. Please contact us if you have any questions or would like to learn more about our fixed income investment strategies.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management