Volatility is the Price of Admission

Higher uncertainty about the economy equals higher volatility for the stock market. Whether it is a Chief Financial Officer modeling a new project or investors modeling stock prices, more uncertainty of the future makes it harder to forecast. Coming in to 2022, major questions remained about the end of the coronavirus and the Federal Reserve’s path of interest rate increases. This uncertainty was increased with the buildup of troops on the Ukraine border and now the invasion of Ukraine. In the short-term the stock market can be driven by investor’s emotions, but over the long run the stock market return should mirror growth in earnings. We expect volatility to stay heightened until we get more clarity regarding Federal Reserve policy and the situation in Ukraine. Despite the increased volatility, we still expect equities to provide better returns over the next three years versus cash and fixed income.

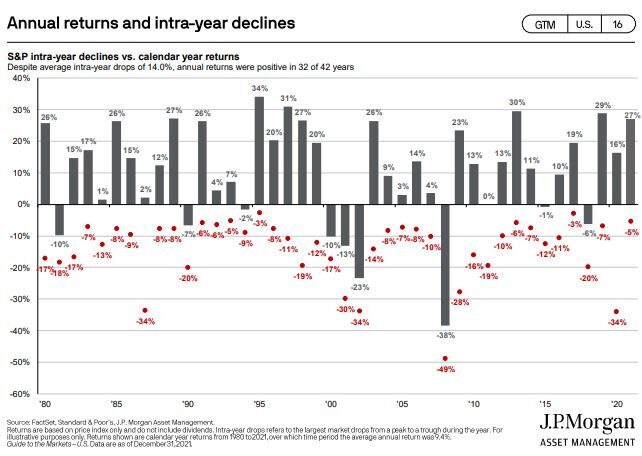

As the above chart from J.P. Morgan shows, since 1980 the S&P 500 index has averaged an inter-year drop of 14% but annual returns were positive 32 of 42 years. This volatility, or risk, is the reason investors have received excess returns over the long run. The secret to enjoying these returns is to not panic during pullbacks and sell. In fact, pullbacks have historically provided opportunities to either add to equities or adjust portfolios and replace lower growth stocks with higher growth stocks. This is why at year-end we recommended in our market outlook that clients keep several years of upcoming expenses in safe and short-term maturity bonds to ride out these pullbacks.

In January, the consumer price index rose 7.5%. This led to a significant range of expectations for future rate hikes by the Federal Reserve. In January, the Federal Reserve dot plot signaled three .25% interest rate hikes for 2022. However, investment banks are forecasting a range between four and seven .25% interest rate hikes. The uncertainty regarding the magnitude of interest rate hikes, and the impact on the economy and corporate earnings, has caused much of the volatility this year. We believe the Federal Reserve will be deliberate in their process and anticipate the number of rate hikes will be at the lower end of the range. The Federal Reserve is ending its bond purchases and we believe they want to see the effects on the economy before they aggressively raise interest rates. The invasion of Ukraine only adds to the uncertainty about the economy. The increase in price of oil could lead to higher inflation. Will the Federal Reserve view this increase as temporary or decide to raise interest rates quicker and higher than previously indicated? This uncertainty is contributing to the volatility of the market this week.

The good news is that over the long-term the stock market is driven by earnings and not emotions. Twenty years ago the S&P 500 was at 879.82 and earnings were at $46.04 a share. At the end of 2021 the S&P 500 was at 4766.18 (annual return of 9%) and earnings were $205.5 a share (annual increase of 8%). After the current pullback, the S&P 500 has grown at 8% a year and earnings at 8% a year. If higher interest rates and/or the invasion of Ukraine doesn’t permanently slow earnings growth than we should continue to expect equities to provide better returns versus cash and fixed income.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk.

Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.