2022 First Quarter Review and Outlook

The S&P 500 finished the first quarter of 2022 down 4.67%. It was a volatile first quarter and on March 8th the S&P 500 was down 12.6% for the year. The negative returns were driven by high inflation (7.9% in February) and the invasion of Ukraine by Russia. Despite these headwinds, S&P 500 earnings expectations for 2022 increased from $220 to $225. The U.S. economy continues to be very strong with approximately 5 million more job openings than unemployed workers. The Federal Reserve is expected to raise interest rates to control inflation. Historical data has shown that interest rate increases can take two to three years before causing a recession. Continued earnings growth should provide equities a better return over the next few years versus cash and fixed income. As we discussed in our February 24th note, increased volatility is not a reason to lower exposure to equities. Depending on a client’s risk/reward tolerance, we recommend keeping between three to five years of upcoming expenses in cash and short-term maturity bonds. We recommend the remaining part of the portfolio be invested in diversified equities.

In February, inflation as measured by the Consumer Price Index (CPI) was 7.9%. With rising energy prices and continued supply chain disruptions, it could take several more months before inflation begins to moderate. The Russian invasion of Ukraine, combined with less covid restrictions, helped drive the price of oil from $75 a barrel to $107 a barrel. Higher commodity prices combined with persistently higher inflation has raised the markets expectations of future interest rate hikes. Currently the futures market is projecting almost a 40% chance that the Federal Funds rate will be between 2.5% and 2.75% at the end the year. There is a 16% chance that interest rates could be between 2.75% and 3%. This has driven interest rates up across the yield curve.

|

The Significant Rise of U.S Treasury Yields in the First Quarter |

||

| 12/31/2021 | 3/31/2022 | |

| 2-Year | 0.73% | 2.44% |

| 5-Year | 1.26% | 2.56% |

| 10-Year | 1.52% | 2.32% |

| 30-Year | 1.90% | 2.44% |

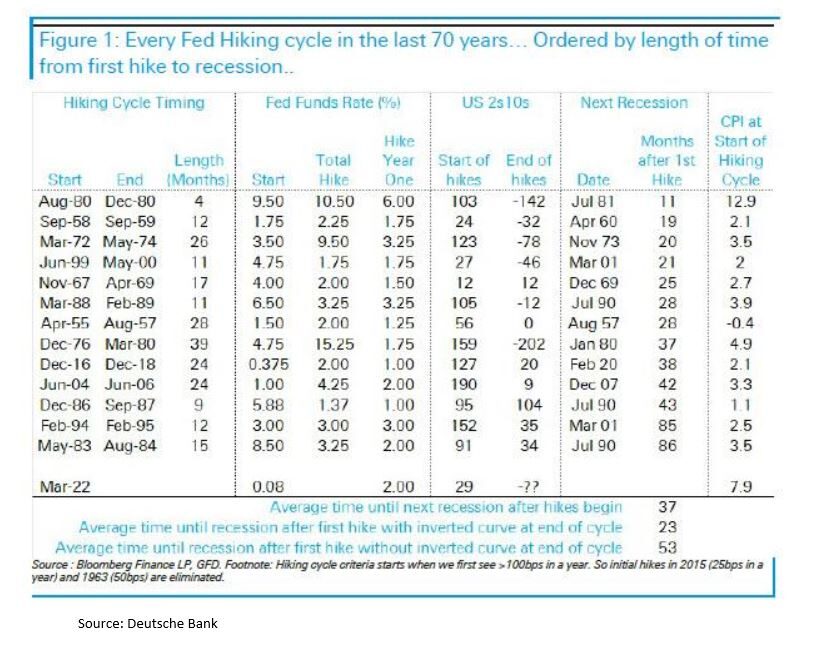

Investors have also been worried about an inverted yield curve – when the rate on the 2-year government bond is higher than the 10-year government bond. The implication is that an inverted yield curve is forecasting a recession. According to Dow Jones Market Data, the yield curve has inverted seven times since 1977 and the S&P 500 has been an average of 11.8% higher after a year – falling on just one occasion following the February 2000 inversion. In the last 70 years, the Federal Reserve has embarked on 13 hiking cycles. According to Deutsch Bank, it has averaged 37 months from the first rate hike until a recession begins.

In February, the Bureau of Labor and Statistics reported job openings of 11.226 million. In February, the unemployment rate was 3.8 percent with 6.27 million unemployed people. The tightening labor market can lead to higher wages, this would increase inflation and could lower earnings for specific companies that have a higher percentage of expenses tied to employee expenses. At Virtue Asset Management, we continue to focus on companies that have pricing power and lower exposure to employee expenses to protect portfolios from higher inflation. We view the large amount of job openings as a positive sign that the U.S. economy will continue to grow and prosper.

Despite the negative return in the first quarter, U.S. stocks continue to outperform the rest of the world. U.S. large cap stocks did slightly better than mid cap and small cap stocks. International and emerging market equities continued to underperform U.S equities. With the rise in interest rates in the first quarter, bonds as measured by the U.S. aggregate bond index, provided a worse return than the S&P 500. We continue to recommend overweighting U.S. stocks compared to international stocks. For investors interested in investing in individual countries we continue to recommend exposure to India over China.

| Index |

2022 1Q Return |

| S&P 500 | -4.60% |

| S&P 500 Growth | -8.59% |

| S&P 500 Value | -.16% |

| S&P MidCap 400 | -4.88% |

| S&P SmallCap 600 | -5.62% |

| MSCI EAFE | -6.77% |

| MSCI Emerging Markets | -7.79% |

| MSCI China | -15.57% |

| MSCI India | -2.77% |

| Bloomberg US Agg Bond | -5.93% |

| TIPS Bond | -3.03% |

| iShares iBoxx $ High Yield Corp Bd | -4.53% |

For 2022, analysts’ earnings estimates have increased from $220 a share to $225 a share. Using those earnings, the forward P/E ratio is currently 20. Over the last five years the forward P/E has averaged 21.62. Using this metric, the S&P 500 could increase approximately 8% from these levels. It seems unlikely that investors will apply a higher P/E multiple in an environment of rising interest rates. The upside potential of the S&P 500 is that earnings could be higher than $225 a share and are expected to grow over the next few years – current estimates for 2023 are $246 a share. Every $10 increase in S&P 500 earnings could provide another 5% return using the current P/E level. Despite the risk of inflation and a slowing economy, the upside potential of stocks provides a better risk/reward profile than cash and fixed income. With rising interest rates and higher inflation, the outlook for cash and fixed income is a negative return over the next few years. We recommend that clients be prepared for lower returns of equities over the next few years and increased volatility. However, we expect equities to have a better return over the next 3 years versus cash and fixed income.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. Reliance upon information in this letter is at the sole discretion of the reader.

Please consult with Virtue Asset Management’s financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk.

Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD #283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management